Expense Reimbursement Form Templates

A reimbursement form is used by most businesses and non-profit organizations. A new employer will soon realize they need a way to reimburse employees for general business expenses like office supplies, mileage, software, training fees, etc. For travel, you can use the Travel Expense Form or Mileage Tracker , but for these other expenses, a general reimbursement form will suffice. All you need is a simple spreadsheet for this type of form, so our Employee Expense Reimbursement Form below is just the thing. I have also added a new printable PTA Reimbursement form.

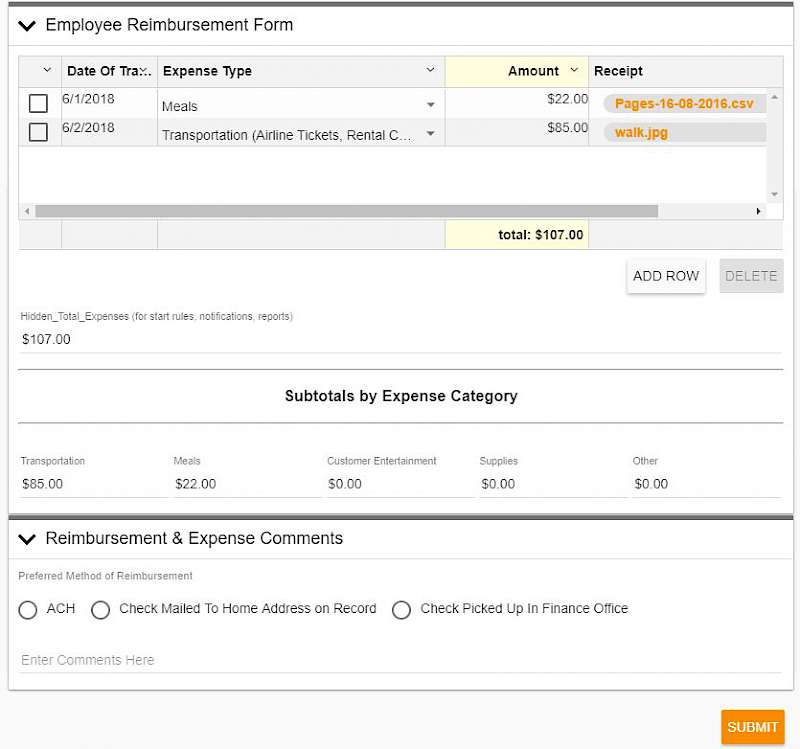

Employee Expense Reimbursement Form

Other versions.

License : Private Use (not for distribution or resale)

"No installation, no macros - just a simple spreadsheet" - by Jon Wittwer

Description

This reimbursement form was designed to allow employees to request reimbursement for general business expenses.

For travel-related expense reimbursement, use the Travel Expense Report . If you routinely use a vehicle for business purposes, download our Mileage Tracking Log .

Reimbursement Form with Receipts

Including digital receipts with reimbursement forms is becoming increasingly popular. Attaching electronic scans or photos of your receipts along with your form via email is an option. But, with this template you can insert images of your receipts below the form. Then you can print the form with the included receipts as a single PDF file.

New for Google Sheets: Google Sheets allows you to insert images into cells, so this could be done with receipts. However, GS currently doesn't have a great way to easily view larger versions of the images within cells. This template uses a separate worksheet to allow viewing the larger versions of the images.

How to Reimburse Employees for Business-Related Expenses

For employers.

Customize the template and then give a copy of the form to your employees when they need to submit a request for expense reimbursement. Make sure they know to attach a copy of their receipts. Remember to customize the list of items in the Categories worksheet and keep the mileage rate note up-to-date (see the references below for the current rates).

It would probably be good to write-up a short document that you can give your employees as a guide for what types of expenses you will reimburse and any other policies that you want to put into place (such as requiring an employee to get prior approval for any purchase over $XX).

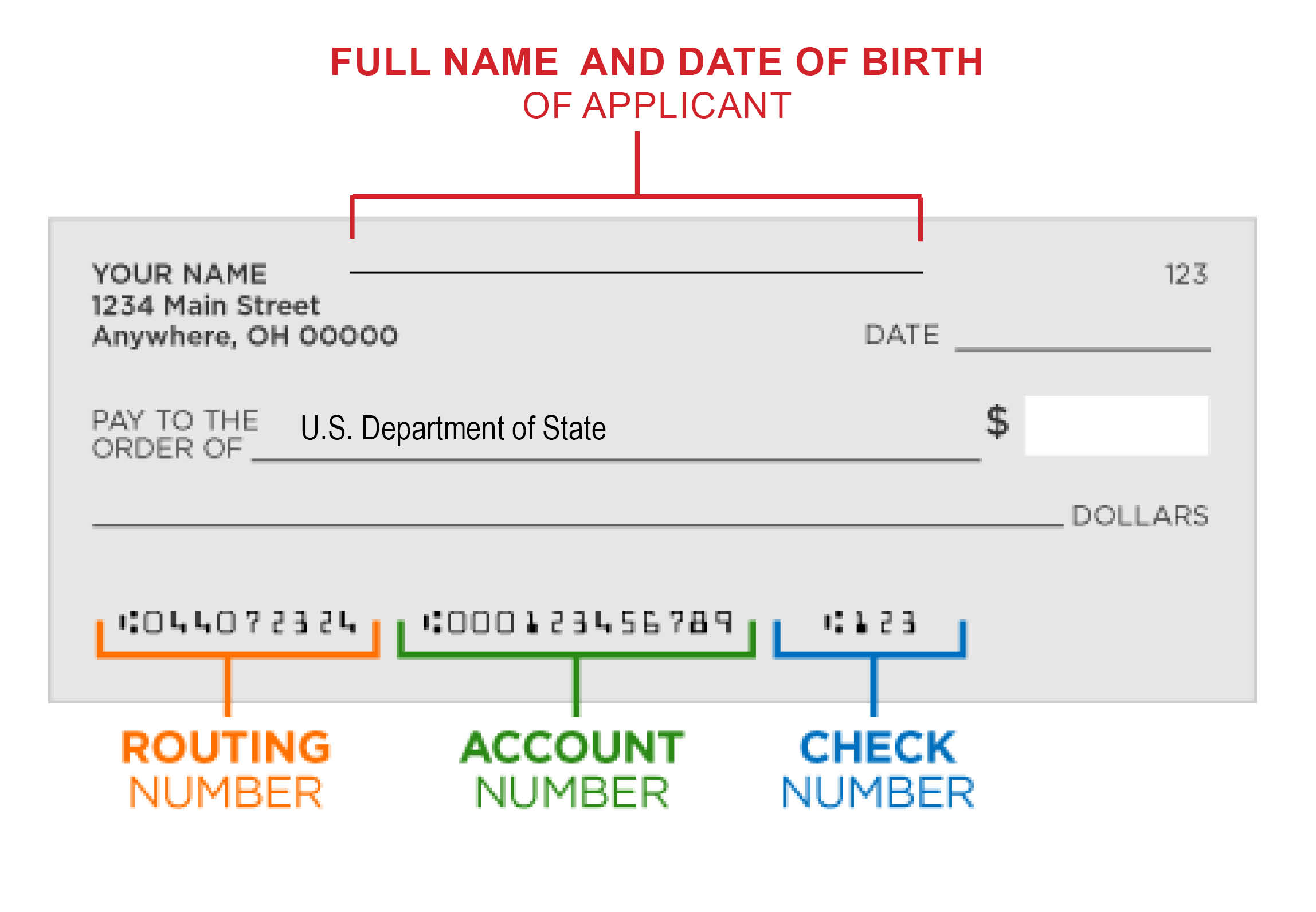

Processing a Payment : For accounting purposes (assuming you are using an "accountable plan" - see IRS Publication 463), I find it simpler to write a separate check than to include the reimbursement in a payroll check. Employees may appreciate being reimbursed as soon as possible, instead of waiting for the normal paycheck. If you write a check, make sure to write Expense Reimbursement in the Memo field or otherwise indicate that the check is a reimbursement rather than a normal paycheck. See IRS Publication 463 for detailed rules.

For Employees

For each expense, choose an appropriate category. If you have questions about how to use the form, ask your employer. Don't forget to attach copies of your receipts.

Important : Keep a copy of your receipts and your reimbursement request form for your own records!

Business Meals: For business meals to be tax-deductible, there must be a clear business purpose, along with a receipt. You might include the purpose for the meal in the Description if you are listing many items on a single form.

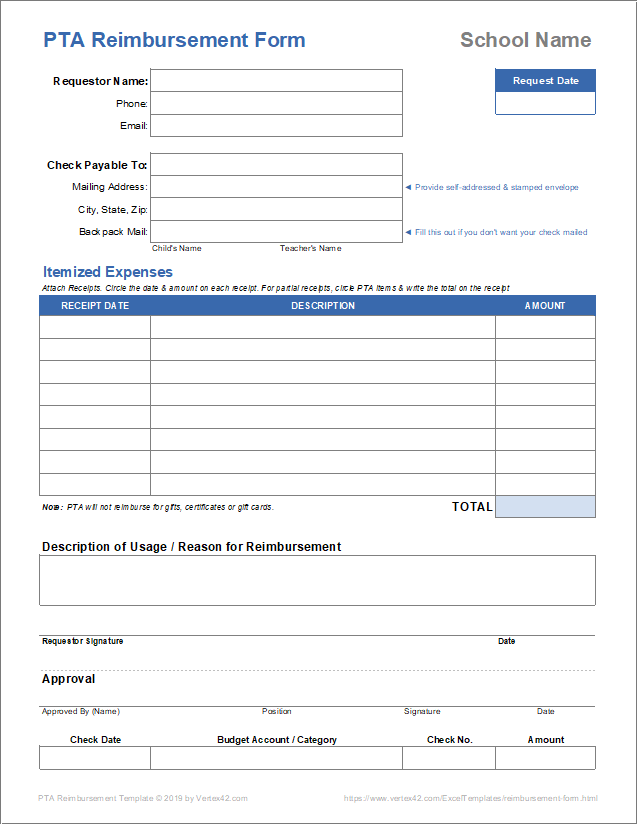

PTA Reimbursement Form

My wife was PTA treasurer this year (2018-2019), so we based this form on how our school's PTA handles reimbursements. You can use this form to create a printable reimbursement form for your PTA, PTO, or similar organization.

- IRS Publication 463 (Chapter 6) at irs.gov - How to Report Expenses (information for both employees and employers)

- Mileage and Per Diem Rates at www.gsa.gov - U.S. General Services website providing mandated rates for mileage reimbursement and per diem.

- Standard Mileage Rates at www.irs.gov - The IRS's table for employees and self-employed individuals.

Follow Us On ...

Related templates.

Sponsored Listings

Timesheets & payroll, for the office.

Published In: Forms

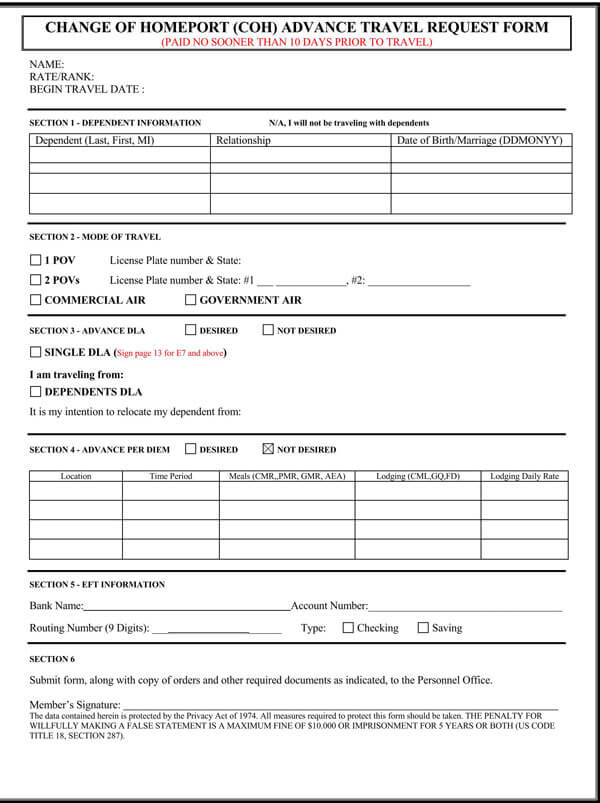

Travel Request Forms and Templates

Travel request forms are forms filled by an employee who is bound to travel for business purposes. The purpose of a travel request letter is for a company to carter for the expenses during the entire travel period. This depends on the agreement of the employee and his or her employer. This article discusses the uses, purpose, and contents of a travel request form. Templates are also provided.

What is Travel Request Form?

This document incorporates all the details needed by a traveler to forward for approval from the management before commencing travel. The contents of a travel request form include destinations, travel dates, mode of transport, meals, accommodation, among others. The travel request form also shows a traveling place as well as the expenses incurred. This document can fulfill several purposes: securing permissions for travel or seeking approval from companies on behalf of the traveling employees.

Importance of Using Travel Request Forms

Just like any other business document, a travel request form carries significant importance.

These documents ensure that travels within the company are:

- Feasible: Sometimes, the resources and funds within a company can be limited. This makes it essential to ensure that every available resource is put into good use. By doing so, the company’s finances will be stabilized.

- Authorized: It is very important for travel requests to go through proper departments and channels before it gets authorized in a business.

- Organized: These forms can also be kept and stored for future reference. Given that there is a form for every purpose, you need to ensure that these forms are organized to prevent confusion and clutter. It also allows easier access to documents when one needs them for reference.

Steps to Write a Travel Request Form

In order to write a travel request form efficiently, you simply need to follow two steps in a detailed manner.

These two steps are as follows:

Provide the details of the traveler

In the travel request form, including details of the traveler. This information includes the full names, contact information, designation employee id, email id, and fax number. Besides, don’t forget to mention why you are going on the trip. This should be indicated in the transfer request form.

Provide information regarding the trip

You must provide information relating to the trip. This includes the date and time of departure as well as the arrival time. Other things to write include the travel schedule, mode of transport, accommodation, travel itinerary, and meals.

Information to be Included in a Travel Request Form

For your travel request form to be composed in the most efficient manner, you must include the following information in it:

Personal information

This is the information belonging to the traveling employee. The Information needed to be filled in this document includes the individual’s name, contact information, job position, and respective department.

Travel request information

This is the information regarding the actual trip. It includes the date of travel, the purpose of travel, the duration of travel, destination, and estimated cost of travel. It is important to ensure that all these details are indicated in the letter.

Indicate travel expenses and information regarding sponsorship

A travel request form should indicate the trip’s estimated expenses, including costs of meals and accommodation, transportation expenses, travel expenses, and car rentals, among others. If the trip is being sponsored, remember to include the contact information and details of the sponsors.

Mention the names of all the authorized persons

You cannot forward a travel request form unless a higher authority approves it. This is why you should mention all the names of authorized individuals, leaving a space for their signatures.

Ensure you incorporate all terms and conditions

To ensure that everything is working properly and meets all the transparency standards, incorporate all the terms and conditions. They should be clearly described in your form to avoid any inconveniences.

Put Accurate Information in a Travel Request Form

You must provide accurate information in your travel request form.

Here are some of the reasons why it is essential to do so:

Accurate information is crucial in a travel request form. In a company, you might not be the only individual asking for a travel request. To avoid mix up, you should indicate the details in your form. Make sure that the name is written, your destination, and other crucial details.

Furthermore, accurate information increases trustworthiness. When it comes to finances, don’t indicate inaccurate figures. Some people get tempted to indicate higher figures so that they can pocket the extra cash. For example, don’t allocate an inaccurate accommodation fee so that you can pocket the extra money. You should always provide honest and accurate information in your travel request form.

Download Templates

You can download our free travel request form templates. These templates can also be customized to fit your preferences.

Companies require receipts for employee expenses for two reasons: to confirm that employees are spending money how and when they claim and to back up deductions listed on the business’s tax return.

The comment section of a travel request form should include remarks on the importance of the trip. If you are applying, back your application up by giving reasons why the trip is important.

It depends on the policies of the company. In some companies, once the funds have been availed, it is impossible to cancel the request. In most companies, however, you can cancel the request even after it has been approved.

Travel request forms play an important role in organizations. For the best outcome, you can use our prepared available templates. They are easy to use and can be customized.

Related Documents

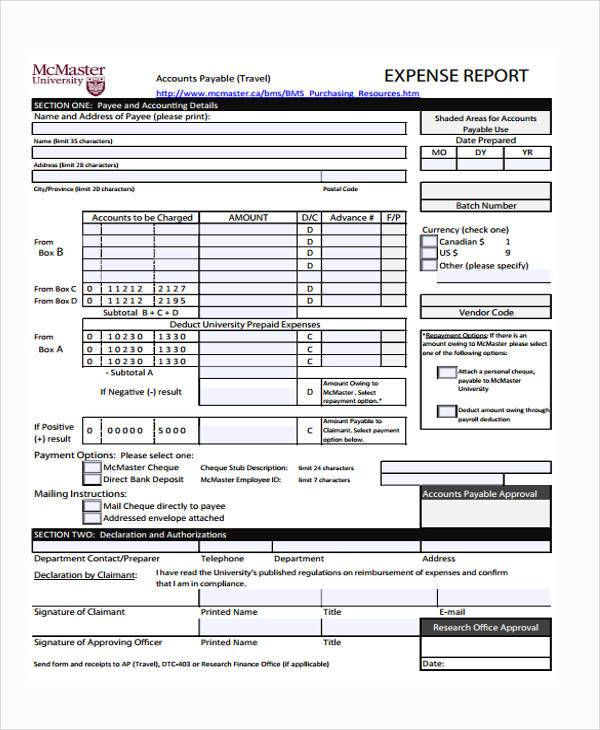

Free PDF Expense Report Templates and Forms

By Andy Marker | January 3, 2023

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve compiled a collection of the most helpful free PDF expense report templates and forms for recording business expenses and ensuring that employers reimburse team members in a timely fashion.

Included on this page, you’ll find a simple printable expense report form , a business expense sheet , an employee expense report with mileage template , and a monthly expense report template . Plus, find helpful tips on using these templates.

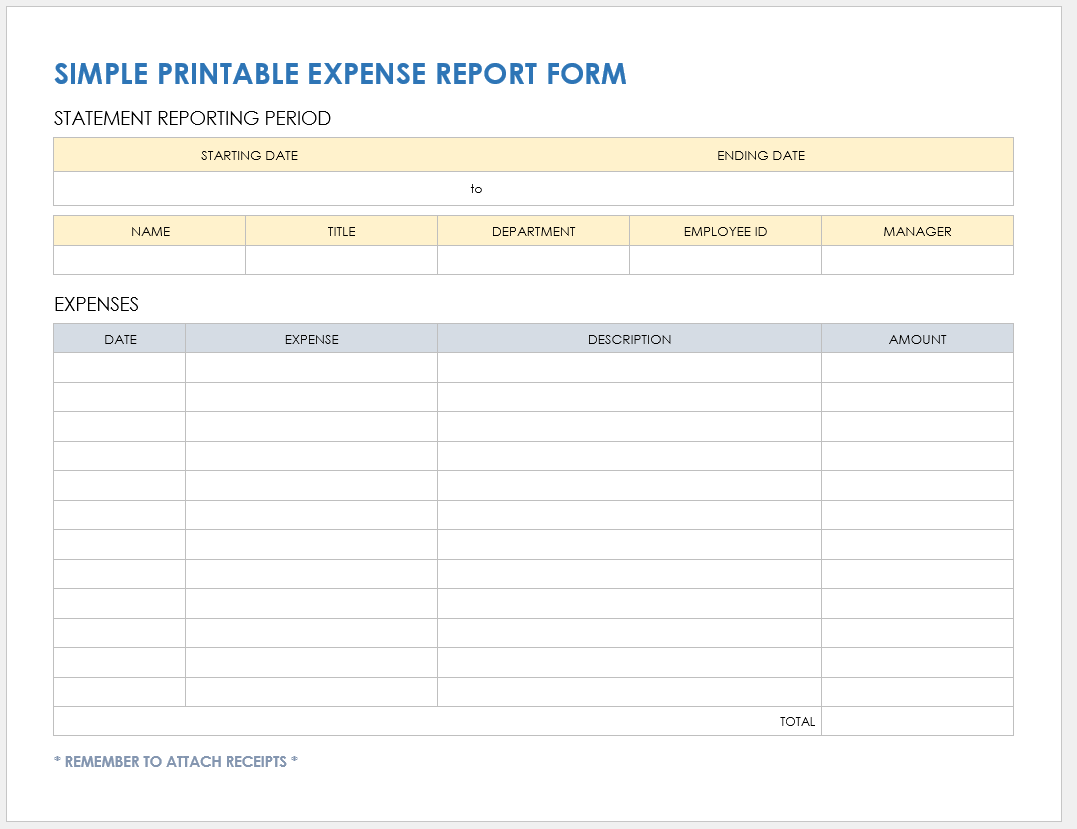

Simple Printable Expense Report Form

Download the Simple Printable Expense Report Form for Adobe PDF

This basic printable expense report template simplifies the expense reporting process for employees and ensures that managers can issue reimbursement quickly. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). Enter the cost for each item, along with any advances, to calculate the total reimbursement amount, or print out the template to perform the calculations by hand. Whether you fill out this PDF template online or print a hard copy to submit to your manager, this easy-to-use template will help you streamline your expense reporting procedure.

For expense resources geared toward smaller businesses, see this article on small business expense reports, trackers, and spreadsheet templates .

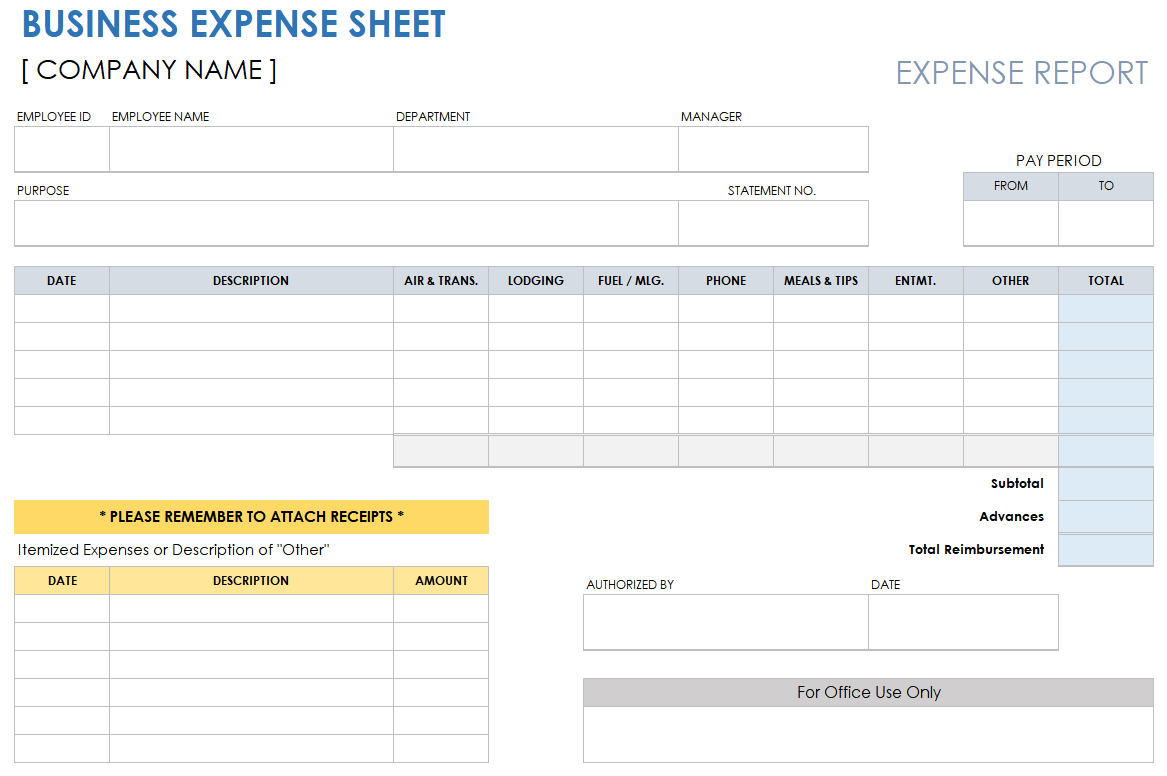

Business Expense Sheet

Download the Business Expense Sheet for Adobe PDF

Proactively track all of your business expenses with this business expense sheet for Adobe PDF. For each expense, enter its date, description, category, and amount. The template’s Total column keeps a running tally of your total reimbursement amount. The template will calculate the subtotal of your expenses and subtract any advances you enter to provide your total reimbursement amount. Be sure to attach receipts to your expense report to ensure timely reimbursement.

Check out these free expense report templates in multiple file formats to track your expenses and meet your reimbursement needs.

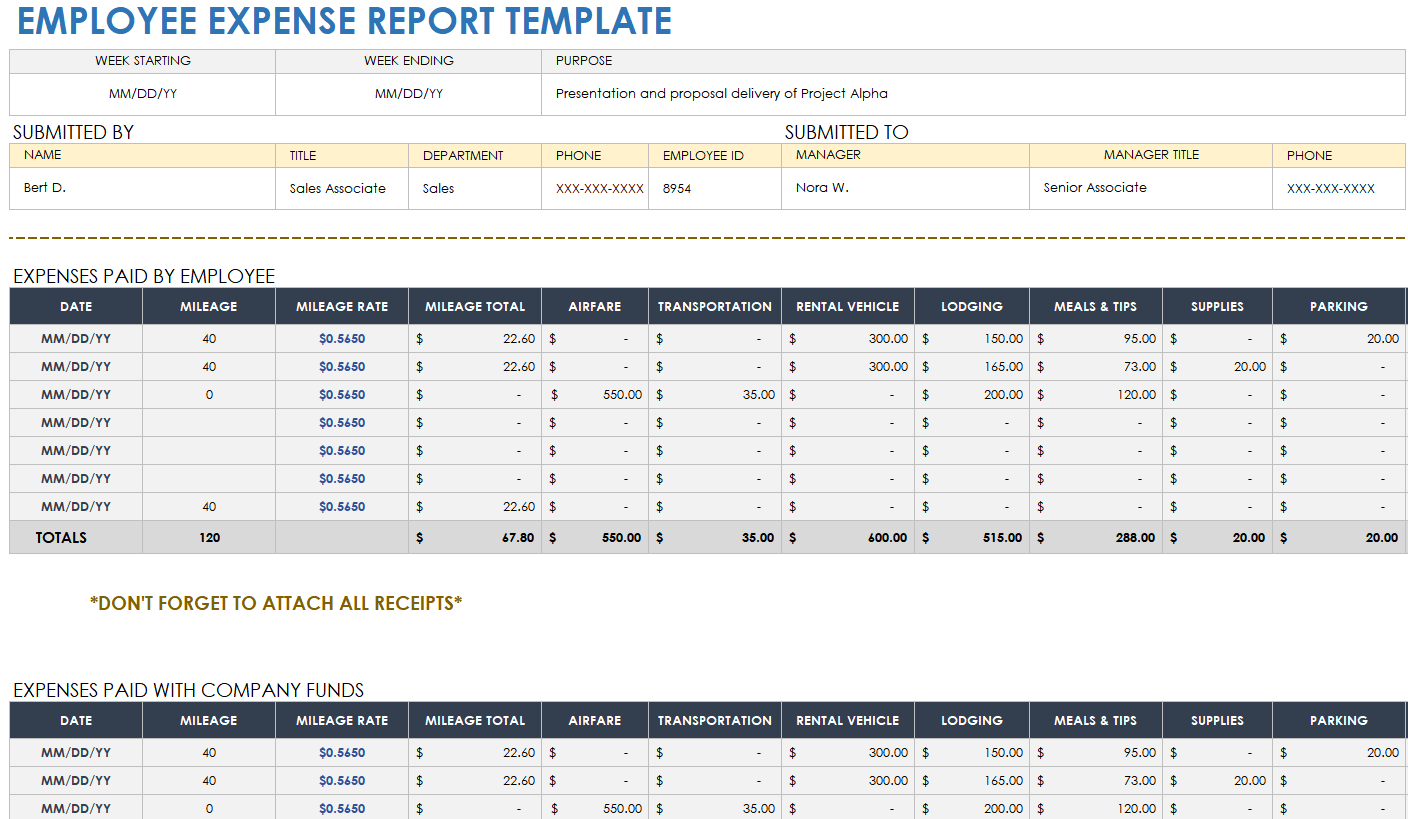

Employee Expense Report with Mileage Template

Download the Employee Expense Report with Mileage Template for Adobe PDF

Designed to track costs for business-related mileage or travel, this employee expense report with mileage template is the perfect tool for recording every mile or kilometer you travel. Under the template’s Mileage column, track each day’s traveled distance. Tally the total mileage of your trip, as well as any other transportation expenses you’ve listed, in the Transport/Mileage field at the top-right corner of the form.

Check out this expense tracking and reporting set for optimized business expense tracking needs.

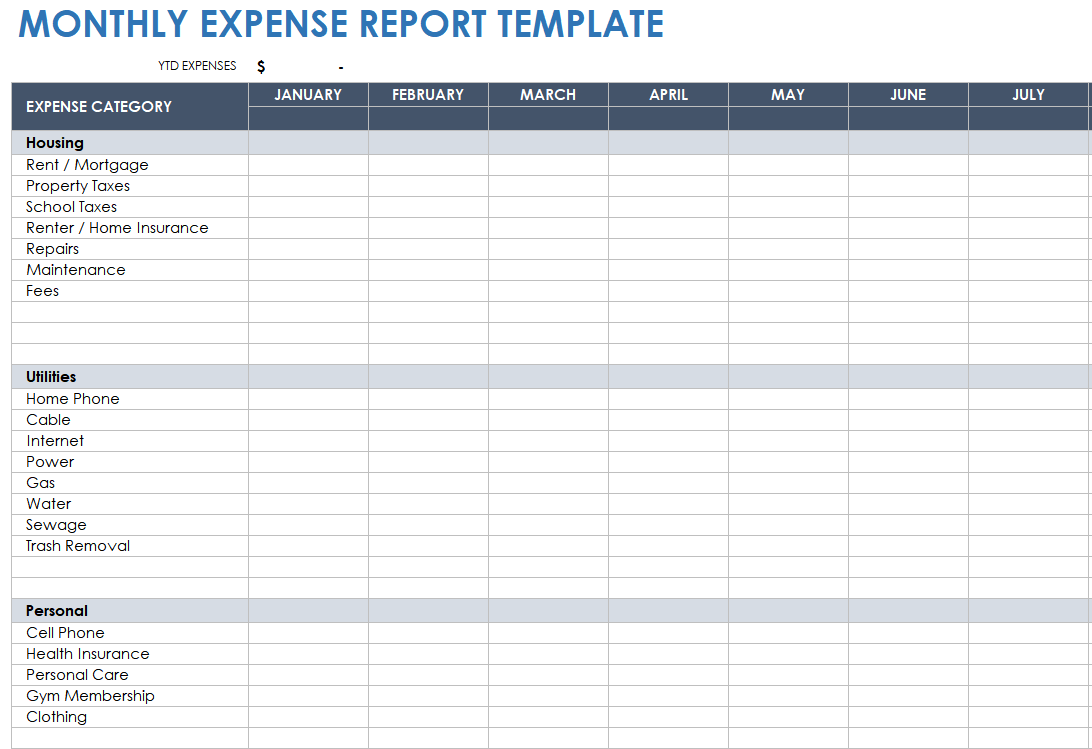

Monthly Expense Report Template

Download the Monthly Expense Report Template for Adobe PDF

Use this template’s unique month-by-month tabs to provide a comprehensive, multi-month account of all your reimbursable business expenses. While monthly tabs help you provide greater detail of each month’s accrued expenditures, this template’s main Monthly Expense Report tab allows you to keep a running tally of your monthly and total expenditures. You can adjust this completely customizable template to create different expense categories and get reimbursements for every business-related expense quickly.

For additional expense report resources and templates, see these comprehensive articles on expense report templates in Excel and expense report templates in Google Sheets .

Effectively Track Monthly Expenses with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

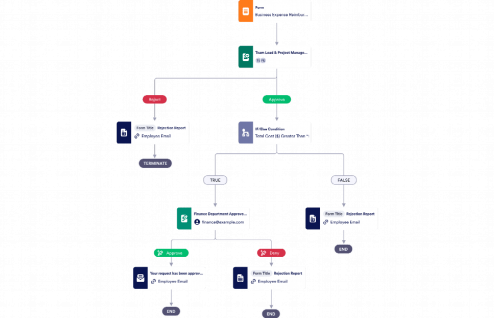

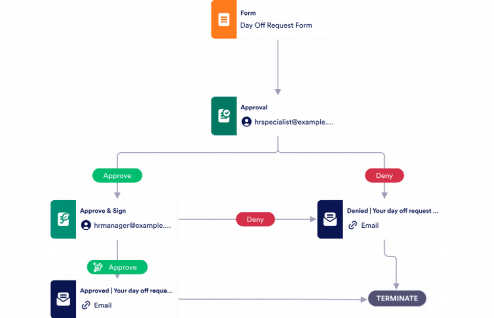

Travel Expense Approvals | Manage Expenses Better

Travel and expense approvals can be easily managed with workflow automation software from integrify..

Managing Expense Approvals Better

If an employee requires approvals from multiple managers related to requests for travel and entertainment of customers, approvals can be requested in person, by fax, or through email. This creates inconsistencies. Neither management nor the employee is able to see where requests are in this process. Important events and travel needed to support the business is often delayed and even canceled due to the request not receiving approval in a timely matter.

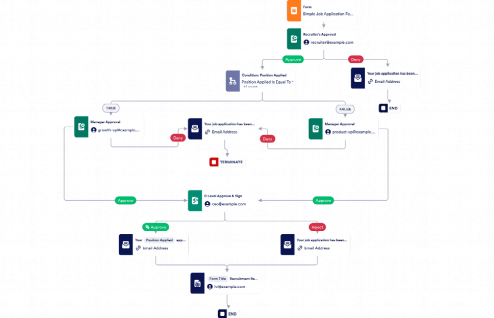

Using Workflow Automation for Approvals

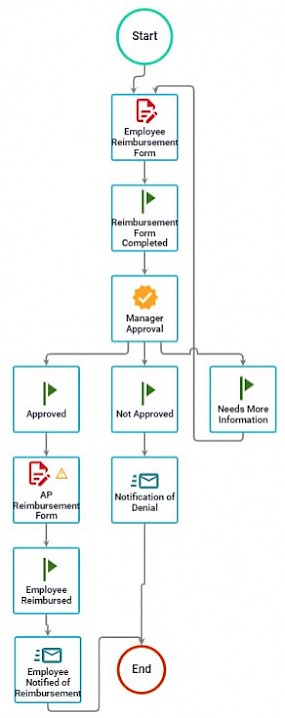

Setting Up an Expense Approval Process

Assign process administrators to Integrify to implement the process rules and any forms that will be used to gather information. Integrify automatically executes the web and email approval notifications to the right people, reducing the chances of confusion while maintaining the current status of the request. With Integrify, managers respond using a single web-based application. Each request is tracked and managed to provide business managers with up-to-date information for all travel requests. The application allows each request to be submitted, received, reviewed, approved, tracked, monitored, and reported. Groups responsible for making the travel arrangements can review the approved request and easily provide the details necessary for the employee to support business development.

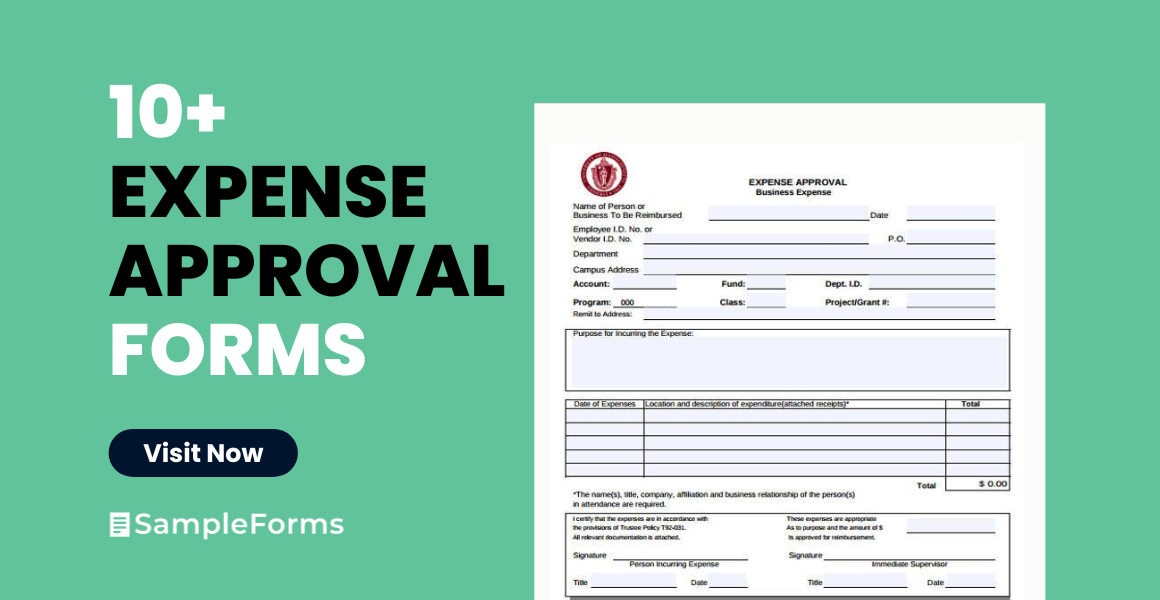

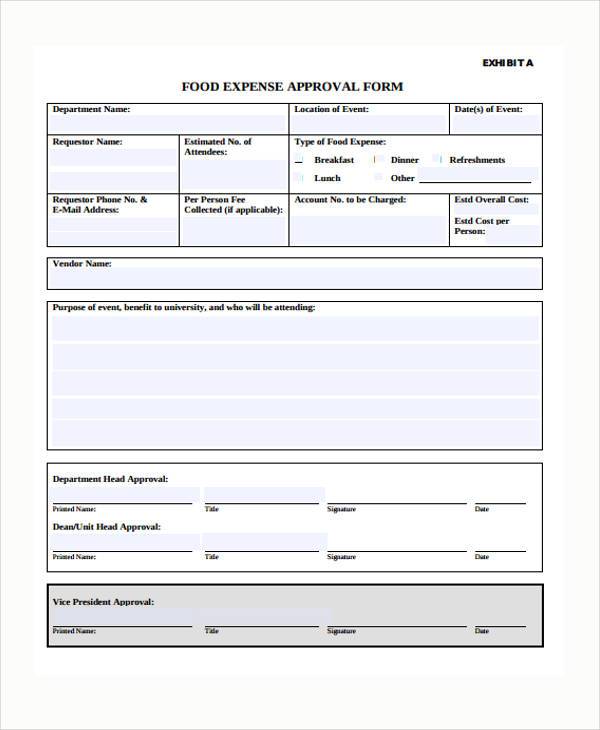

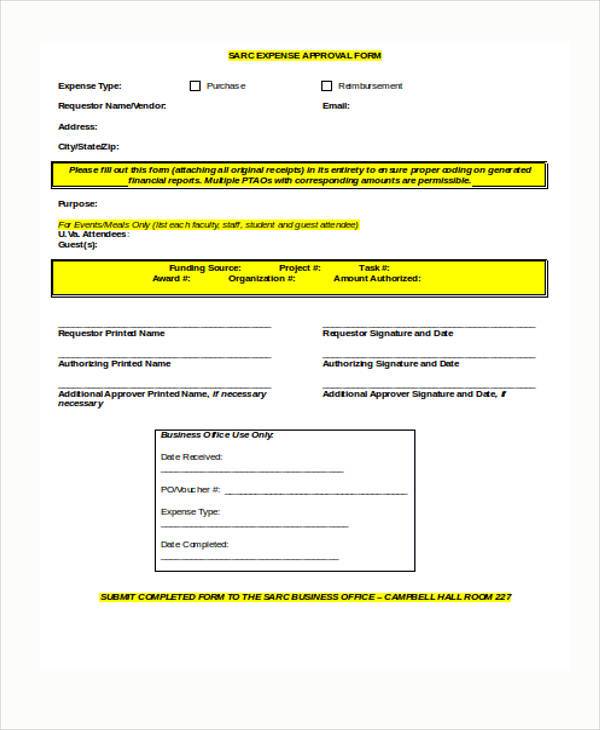

Expense Approval Form

With Integrify you can design and deploy approval forms to match your organization's needs and standards. Design dynamic forms that only include relevant information and pre-fill known information to improve the user experience. Here's an example:

See Your Own Expense Request/Approval Process in Action

Get a Demonstration of Integrify and we'll provide a custom demonstration based on your unique process.

Automate Any Expense Approval Process

To see how quickly you can begin automating your expense approval processes, request a demonstration or trial of Integrify.

Get a Free Demo

- Accounts Payable Software

- Accounts Receivable Software

- Travel & Expense Management

- Payment Automation

- Cash Flow Management

- Account Payable

- Account Receivable

- Travel & Expense

- Finance News

- Press Release

- Get Started

Travel Expense Reimbursement – All You Need to Know

Traveling for business can be exciting and rewarding, but it comes with its challenges, especially when it comes to managing travel expenses. Business travelers often face various expenses like airfare, hotel stays, meals, and transportation. These expenses can add up quickly and become a burden if not reimbursed promptly.

Similarly, for travel managers and finance departments, managing these expenses and receipts can be time-consuming and tedious.

In this blog, we’ll discuss the travel expense reimbursement process, covering different types of expenses, their importance, and best practices.

What is Travel Expense Reimbursement?

Travel expense reimbursement is the process where a company repays its employees for expenses they incur while traveling for work. These expenses typically include costs for transportation, lodging, meals, and other related expenses.

Employees are usually required to submit a detailed report of their expenses, including receipts, to the company’s finance department or travel manager. The company then reviews these reports and reimburses the employees for the approved expenses.

Reimbursement is important because it ensures that employees are not out of pocket for expenses related to their work duties. It also helps companies manage their travel budgets effectively by tracking and controlling expenses. Proper reimbursement processes can improve employee satisfaction and ensure compliance with company policies and tax regulations.

What are the Different Categories of Travel Expenses?

During the travel expense reimbursement process, traveling employees, travel managers, and finance departments need to understand the different types of travel expenses:

1. Transportation Expenses

These expenses include the money spent by employees on transportation to their business trip destinations. This can include the cost of flights, cab fares, train tickets, or mileage if employees use their vehicles. For mileage, companies often follow the mileage reimbursement policy, which sets a standard rate per mile driven for business purposes.

2. Accommodation Expenses

Accommodation expenses refer to the costs employees incur for arranging their stays during a business trip. This can include charges for hotel rooms, resorts, lodges, Airbnb rentals, and other forms of lodging. Reimbursement for accommodation is typically based on the company’s travel budget and varies depending on the type and duration of the stay.

3. Client Entertainment and Meals

These expenses encompass the costs incurred by employees to entertain or engage with clients or prospective clients for business purposes. This can include expenses such as taking clients out for sightseeing, hosting them at live events like sporting events or concerts, and covering the cost of meals and refreshments during these activities. Employees who incur client entertainment and meal expenses are generally eligible for reimbursement.

4. Incidental Expenses

Incidental expenses are nominal costs that employees may incur in addition to major expenses while using certain services during their business trips. These can include expenses such as room service, laundry, and tips to service staff. Companies typically reimburse employees for incidental expenses upon their return from the business trip, provided they are within the company’s reimbursement policy limits.

Understanding these different types of travel expenses is essential to accurately reimburse employees and manage travel budgets effectively.

Why is the Travel Expense Reimbursement Process Important?

The travel expense reimbursement process is important for several reasons:

- Record-keeping: It helps maintain accurate records of all expenses incurred during business travel, which is essential for tax audits and regulatory compliance.

- Cost control: By setting reimbursement limits and requiring receipts, the process helps control costs and prevents overspending.

- Policy compliance: It ensures that employees adhere to company policies and regulations regarding travel and expense management , reducing the risk of non-compliance and legal issues.

- Employee satisfaction: A smooth reimbursement process boosts employee morale by ensuring they are reimbursed promptly and feel valued.

A well-managed travel expense reimbursement process is vital for effective business travel management.

What is a Travel Expense Reimbursement Policy?

A travel expense reimbursement policy is a document that outlines the rules and guidelines for reimbursing employees for business-related travel expenses. It includes details from pre-travel planning to settling reimbursable amounts. The policy specifies which travel expenses are eligible for reimbursement and which are not.

It also sets limits on the amount the company will cover for certain expenses. Additionally, the policy details the procedures for submitting expense reports and obtaining approvals.

How to Create an Effective Travel Expense Reimbursement Policy

Creating a successful travel expense reimbursement policy involves a few key steps:

- Simplicity: Make the policy easy to understand for all employees. This helps streamline the reimbursement process.

- Clarity: Ensure that the policy is clear and easy to follow. Provide detailed instructions on how to submit expenses for reimbursement.

- Organization: Keep the policy well-structured with clear sections. This makes it easier to update and make changes as needed.

By following these guidelines, you can create a travel expense reimbursement policy that is effective and easy for employees to follow.

What Should You Include in a Travel Expense Reimbursement Policy?

A well-defined policy helps employees understand what expenses are covered, and how to claim reimbursement and ensures compliance with company policies and tax regulations . When creating a travel expense reimbursement policy, consider the following:

1. Detailed Expense Categories

Break down expenses into categories like transportation, lodging, meals, and client entertainment. This clarity helps employees understand which expenses are eligible for reimbursement.

2. Eligible Expenses for Reimbursement

Provide a detailed list of expenses that are eligible for reimbursement. This typically includes costs like transportation, accommodation, meals, client gifts, and visa charges.

3. Expenses Not Eligible for Reimbursement

State expenses that will not be reimbursed, such as personal shopping or travel upgrades beyond the budgeted amount.

4. Tax Considerations for Expenses

Explain the tax implications of travel expenses and reimbursements, ensuring compliance with tax regulations. Differentiate between employee allowances and reimbursements for tax purposes.

5. Daily Budget Allocation (Per Diem)

Set daily allowances for each expense category to manage costs effectively. Communicate these rates to encourage employees to stay within budget.

6. Receipt and Documentation Requirements

Specify what receipts and documentation are necessary for reimbursement claims. This ensures that employees provide sufficient evidence of their expenses.

7. Reimbursement Process Details

Describe the process for submitting and processing reimbursement claims. Include information on who is responsible for approving and processing claims, as well as the timeline for reimbursement.

8. Fraud Prevention and Policy Compliance Measures

Outline policies and consequences for fraud attempts or violations of the reimbursement policy. This helps maintain integrity and adherence to the policy.

Step-by-Step Guide to Travel Expense Reimbursement Process

1. Pre-Travel Approval Process

Employees submit a detailed request for their upcoming travel, including destination, dates, purpose, and estimated expenses. The company provides a standardized form or system for employees to submit travel requests, which are then reviewed and approved.

2. Expense Guidelines and Policies Communication

Upon approval, employees receive clear guidelines on what expenses are reimbursable and the limits of the company’s reimbursement policy. The company ensures that employees understand the expense policy and have access to information about allowable expenses and reimbursement procedures .

3. Expense Documentation and Collection

During the trip, employees are required to keep and collect receipts for all expenses, including meals, transportation, accommodation, and any client-related activities. They organize and store these receipts to submit as part of the reimbursement claim.

4. Expense Report Preparation

After returning from the trip, employees compile all expense receipts and details into a comprehensive expense report. The report includes a breakdown of expenses by category, such as meals, lodging, transportation, and any other relevant expenses incurred during the trip.

5. Review and Approval Process

The finance department reviews each expense report to ensure that all expenses are legitimate, accurately documented, and compliant with company policies. Any discrepancies or questionable expenses are flagged and resolved before approval.

6. Reimbursement Processing

Once the expense report is approved, the finance department processes the reimbursement, typically adding it to the employee’s next paycheck or initiating a direct deposit. Reimbursements are calculated as per the approved expenses and the company’s reimbursement rates and policies.

7. Reconciliation and Reporting

The finance department reconciles the reimbursed expenses with the company’s accounting records to ensure accuracy and compliance. Detailed reports are generated to track travel expenses, provide insights for budget planning , and maintain accurate financial records.

What are the Roadblocks in the Travel Expense Reimbursement Process?

Challenges in travel expense reimbursement include:

- Manual Processes: Using manual processes for expense reimbursement can lead to delays and errors. Passing expense reports through multiple hands increases the likelihood of mistakes or fraud, making the process inefficient.

- Unclear Policies: If travel and expense policies are unclear or too complex, it can lead to confusion and delays in reimbursement. Simplifying policies helps employees understand the rules better and ensures compliance.

- Complicated Workflows: Complex approval workflows can hinder the reimbursement process. Straightforward approval processes help ensure quick approvals and smooth progression of claims.

What are the Best Practices for a Smooth Travel Expense Reimbursement Process?

1. develop a comprehensive expense reimbursement policy.

Craft a detailed policy that is easy for employees to understand. Include clear guidelines on what expenses are eligible for reimbursement and how to submit claims. Specify any pre-approval requirements for certain expenses. A comprehensive policy reduces confusion and ensures compliance with company guidelines.

2. Enforce Timely Submission of Expense Reports

Establish deadlines for submitting expense reports and enforce them rigorously. Send reminders to employees as the deadline approaches. Timely submission of expense reports ensures that reimbursements are processed promptly, which contributes to employee satisfaction.

3. Verify Expense Legitimacy and Compliance

Regularly review expense reports to ensure they comply with company policies. Use expense management software to identify any duplicate or out-of-policy expenses. This helps prevent fraud and ensures that reimbursements are fair and accurate.

4. Set Clear Guidelines for Approval

Establish clear guidelines for approving expense reports, including who has the authority to approve expenses and what criteria should be used to evaluate them. This can help ensure consistency and fairness in the expense approval process .

5. Offer Open Communication

Keep employees informed about the reimbursement process through regular communication. Provide updates on policy changes and clarify any confusion regarding reimbursement procedures. Open communication fosters trust and transparency, leading to a smoother reimbursement process.

6. Provide Prompt Reimbursements

Process reimbursement requests promptly to demonstrate respect for employees’ time and efforts. Delays in reimbursement can lead to frustration and dissatisfaction among employees, so prioritize timely payments whenever possible.

7. Utilize a Centralized Expense Management System

Implement a centralized system for managing travel expenses. This system should allow employees to easily submit expense reports and track their reimbursement status. It should also provide managers with the tools to efficiently review and approve expenses. A centralized system improves efficiency and reduces the risk of errors.

Closing Thoughts

Implementing an effective and efficient travel expense reimbursement process is crucial for organizations to maintain accurate financial records, enhance employee satisfaction, and comply with tax regulations.

Leveraging technology, such as Peakflo’s Travel and Expense Management Solution , can streamline the process by implementing robust travel expense policies, ensuring policy compliance, and detecting fraudulent attempts.

By utilizing such tools, organizations can simplify the reimbursement process, reduce errors, and improve overall efficiency in managing travel expenses.

- travel and expense

How to Automate Corporate Travel Management in 2024?

How to streamline travel request approval workflow, mastering travel expense report – a complete guide for 2024, latest post, pwc becomes openai’s largest chatgpt enterprise customer and first reseller, streamlining travel and expense management, lufthansa united 14 erps to become a smarter analytical powerhouse, what are business expenses types, taxes, and tips, headspin founder sentenced to 18 months in prison for fraud.

- Accounts Payable

- Accounts Receivable

- Travel and Expense Management

- B2B Payment Software

- Invoice Management

- Procurement Software

- Product Tour

- Saving Calculator

© 2023 by Peakflo. All rights reserved.

Automated page speed optimizations for fast site performance

Word & Excel Templates

Printable Word and Excel Templates

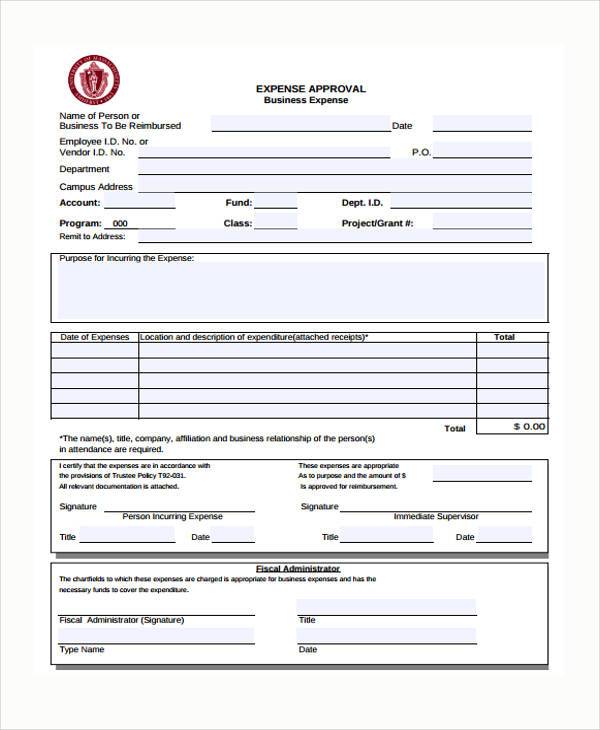

Travel Expense Approval Form

It is a document that is used by the employees of the company to get the approval to make expenses on behalf of the company while traveling.

Some companies ask the employees to provide the travel expense report so that they can reimburse all the expenses through the payroll. However, many businesses require the employee to get the approval of the expenses that the business will incur while traveling.

File: Word ( .doc ) 2003 + and iPad Size 39 KB

Benefits of using the travel approval form:

Using this expense approval form is equally beneficial for both employees and the company.

- Getting approval from the company in advance makes it easier for the employee to set his limits while making expenses. For example, he can choose the type of hotel for his stay depending on the amount of money that his organization has approved to be spent.

- The company can also know the expenses that it is going to incur. This makes the company know about the unnecessary expenses that the employee will make and it can disapprove it.

Key components of the approval form:

The main details of the approval for travel expenses are:

- Details of the employee

- Travel details

- Expenses details

It is always very important for an employee to get approval from the company before making the expenses on its behalf. Some policies are set by the company regarding expense approval. In some companies, an employee must get the approval before spending the money.

Importance of travel expense approval form:

The employees are not responsible for paying any business cost out of their pocket. Whenever an employee spends money for any business purpose, the company is responsible for reimbursing all the money spent by him.

Sometimes, the reimbursement is done after the employee makes all the purchases that were approved by the company. The reimbursement is done by the company separately and it is not part of the payroll, however, some companies also reimburse through the payroll.

Preview and Details of Template

File: Word ( .doc ) 2003 + and iPad Size 81 KB

- Rental Property Condition Assessment Form

- Milestone Chart Template for Excel

- Return to Work Forms

- Reasonable Accommodation Request Form

- Restaurant Waiting Guests’ Checklist

- Visitor Information Form Template

- Project Request Form Template

- Patient Health History Questionnaire

- Computer Training Registration Form

- Payment Request Form Template

- Funds Requisition Form Template

- Budget Request Form Template

- Stationery Requisition Form

- Client Registration Form Template

- Customer Information Forms

- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

- Expense Forms

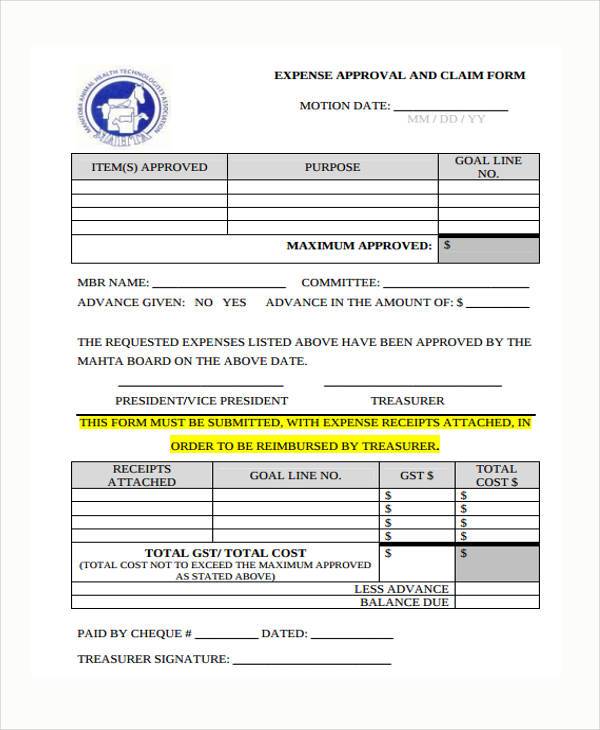

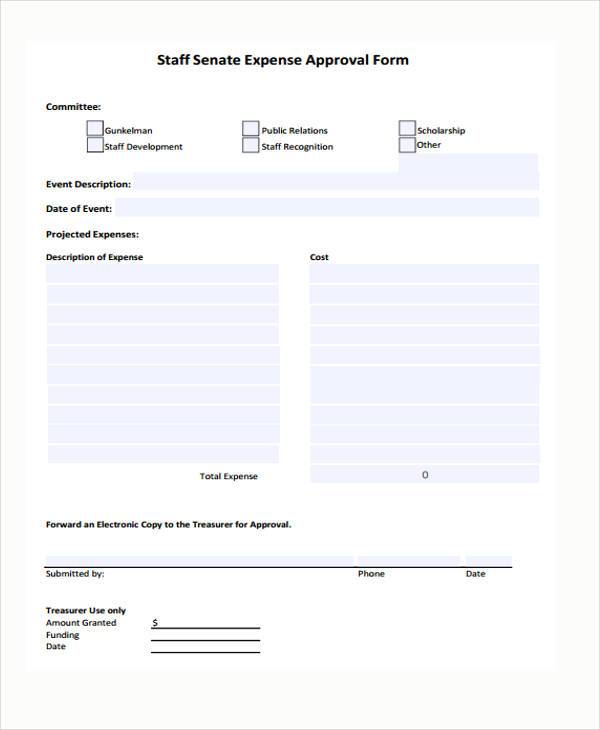

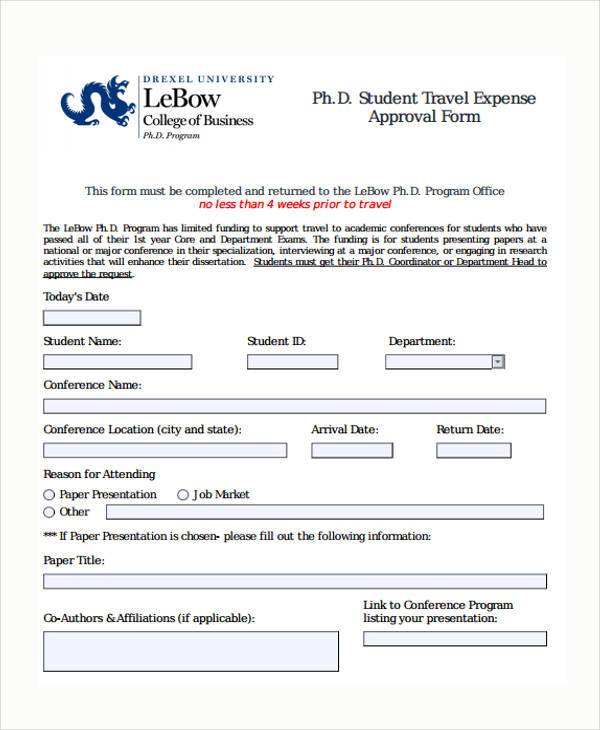

FREE 10+ Sample Expense Approval Forms in PDF | MS Word

Sample Travel Approval Form - 9+ Free Documents in PDF

Free expense forms, 10+ approval forms (travel request and approval form, event and ....

This is common in most organizations today as a means of allowing the branches of the organization to purchase materials needed in advance and sending the expense to the main office. An expense form can be considered as a useful tool in an organizations finances because it is used as a means of requesting payment for certain expenses, as well as cataloging the expenses of the organizations which would allow for easier accounting and fund management.

Business Expense Approval Form

Size: 119 KB

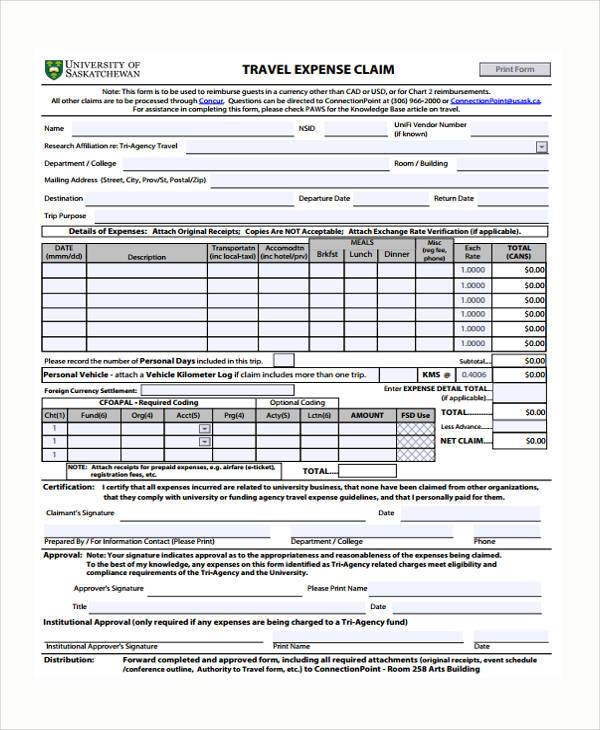

Travel Expense Approval Form

Size: 368 KB

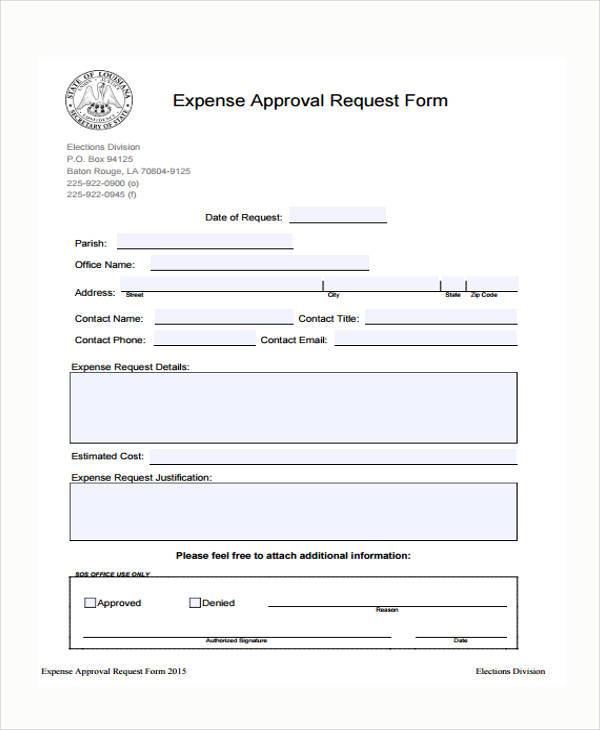

Expense Approval Request Form

Size: 522 KB

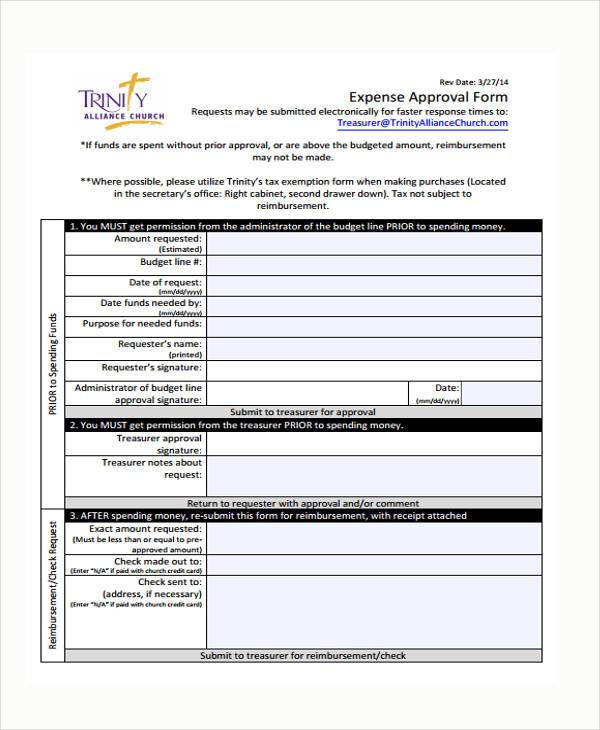

Expense Approval Form Example

Size: 242 KB

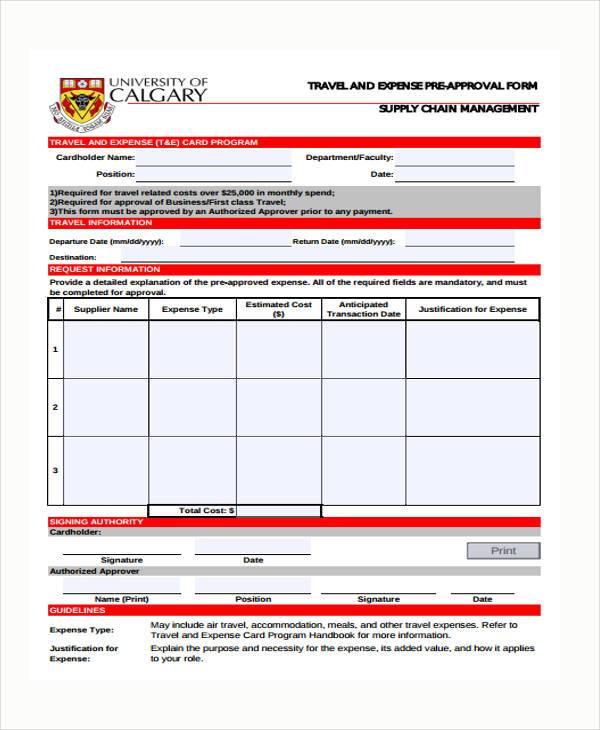

Expense Pre-Approval Form

Size: 49 KB

How to Make an Expense Approval Form?

Making an expense approval form can sometimes be mistaken for writing an expense claim form because both the expense approval form and the expense claim form are commonly used in conjunction with one another. This is because the expense approval form is usually submitted ahead of time of the expense claim form to request or ask permission before incurring the expense.

When the expense approval form is authorized, then the use of an expense claim form comes into play where it can be used as a means of reimbursing cost and expenses. When making an expense approval form, follow the instructions below:

- Begin by identifying the nature of the expense approval form by identifying the title as well as the reason why you are submitting the expense approval form.

- Add in fields that would require the receiver of the expense approval form to identify themselves. Include information relevant to processing the expense approval form such as the position of the person, as well as the means of direct contact. The estimated projections of when and how the expense could improve the working conditions of the organization should also be included.

- Identify the needed amount in the expense approval form.

- Add in areas that will allow for the receiver to approve or decline the document, as well as areas to add the reason why the expense approval form was declined or approved.

- Allow areas for comments and suggestions in the expense approval forms.

Expense Report Approval Form

Size: 306 KB

Expense Approval Form in PDF

Size: 13 KB

Staff Senate Expense Approval Form

Size: 172 KB

Student Travel Expense Approval Form

Size: 78 KB

Food Expense Approval Form

Size: 16 KB

Expense Approval Form in Word Format

What are Travel Expense Forms?

If you ever been on a company business trip, then this type of form is rather common for you. For those who do not know what a travel expense form is, then feel free to continue reading.

A travel expense form is a type of expense form that an employee of a company could submit to the higher ranking officials to apply for either travel reimbursement, or a mileage reimbursement of the total expense the employee incurred during their time travelling to and from the destination.

These are often utilized when an employee uses their own personal resources, such as money and transportation to conduct official company business. If you find yourself in need of these kind of forms, feel free to make use of the free forms available on our website. Make sure to fill these out legibly and accurately to ensure their official documentation usage.

Related Posts

Free 7+ sample business expense claim forms in pdf | ms word, free 14+ sample interview assessment forms in pdf | word | xls, medical report form, 25+ bio data form, 30+ training evaluation form, 10+ real estate open house sign in sheet, 22+ release of information form, 38+ hotel booking form, 11+ teacher recommendation letter, 13+ teacher appraisal form, 57+ declaration form, 12+ marriage contract form, 22+ student evaluation form, 56+ job application form, 31+ evaluation form, sample tuition reimbursement form - 8+ free documents in pdf, sample real estate bill of sale forms - 7+ free documents in word ..., travel request form template, sample travel expense claim form - 11+ free documents in word ....

Travel Expense Authorization and Reimbursement

Before traveling for the first time, travelers should complete their Concur Employee Profile Setup. Subsequently, the profile will only need to be updated when personal information changes. To facilitate the reservation process, please be sure to add your T&E Card to your profile prior to booking. If you are an infrequent traveler without a University issued T&E card, we recommend saving a personal credit card to your profile to be used for hotel and car reservations; airfare may be paid with the Airfare Direct Bill Card which is pre-loaded in the system. All credit card information is redacted for security purposes.

For Profile Setup and/or questions during this process, please refer to the Concur reference page which provides guidance and resources on the following topics:

Additional information about the University’s travel services can be found at the Travel and Payment Card Services website.

- General Resources

- Roles and Responsibilities

- Service Level Agreements

General Questions

Email [email protected]

- Skip to main content

- Skip to main navigation

- Accessibility Statement

More topics

- A. Budgetary Control

- B. Expenditure Control

- C. Reimbursement of Expenses

- D. Payment Processing

- E. Special Types of Disbursements

- F. Journal Vouchers

- G. Revenue Control

- H. Financial Reporting

- I. Tangible Capital Assets

- J. Miscellaneous Administration

- K. Procurement & Disposal

- L. Loss Reporting

- M. Sales Taxes

- N. Vendor Complaints

- O. Internal Vendor Reference Check

CPPM Procedure Chapter C: Reimbursement of Expenses

This chapter of the Core Policy and Procedures Manual describes procedure requirements supplementary to Chapter 10 on travel and for the reimbursement of expenses, such as travel, relocation, business meetings and incidentals.

C.1 Travel Expenses

C.2 approval requirements, c.3 travel voucher (fin 10), c.4 rates and reimbursement, c.5 vehicle travel, c.6 ferry travel, c.7 air travel, c.8 accommodation, c.9 miscellaneous travel expenses, c.10 contractor's travel expenses, c.11 travel expenses in foreign locations, c.12 job interview and post interview expenses, c.13 board and lodging expenses, c.14 travel allowances – officials, c.15 travel allowances – parliamentary secretaries and designated members, c.16 relocation allowances, c.17 business meeting and protocol event expenses, c.18 remuneration for appointees to crown corporations, agencies, boards, commissions and administrative tribunals, c.19 miscellaneous expenses, c.20 childcare expenses, c.21 reimbursement of incidental expenses, c.1.1 general, c.1.2 reasonable accommodation , c.1.3 commercial transportation charges.

- C.1.4 Account Verification Process

C.1.5 Account Verification by the Expense Authority Officer

C.1.6 oracle iexpenses – travel claims.

- All expenses associated with travel must be paid by the employee travelling except for airline tickets and some taxi billings. It is strongly recommended that government employees apply for a travel card to pay travel and other approved expenses and to obtain business travel cash (see CPPM E.3 for Travel Card procedures). See C.14.8 for officials.

- Supporting receipts and invoices (where required by travel policy) with proof of payment must be attached; however, in extenuating circumstances, copies may be certified.

- Travel claims and travel emission calculator reports should be completed and submitted within one week of returning from travel status or at least monthly if on extended travel status.

- Claims for less than the allowable amount are permitted. A brief note should be attached to show the employee is aware of the undercharge.

- The Public Service Act directive on Employment Equity requires managers to provide reasonable accommodation for persons protected under the Human Rights Act .

- Policies requiring less costly travel alternatives still apply. However, once a decision is made that a person with a disability is required to travel reasonable accommodation should be provided to minimize any disadvantage the individual might experience as a result of the disability.

- Persons with disabilities who travel or attend meetings on government business may have special needs. Each deputy minister or delegate may issue special travel authorization, specific to the needs of the individual who has a disability, to enable full reimbursement of additional expenses incurred as a result of reasonable accommodation. For example, a person with a disability may need to pay a hotel rate exceeding the government rate where rooms available are not sufficiently accessible, or an employee who is deaf may require an interpreter at meetings. The accommodation need not be limited to expenses that normally require receipts. Incidental, meal and local transportation expenses may need to be increased to offset the additional costs. See Official Duties Expense Regulation (BC Reg. 226/2001 as amended) for information on officials with physical disabilities.

- Exemptions to the financial policy should be based upon communication between the employee and supervisor with the advice where required of health professionals and human resource/employment equity staff. Managers will exercise judgement in recommending exceptions to financial policy.

- Core Policy 10.3.2

When management designates transportation by commercial carrier(s) and the employee/appointee requests and receives authority to use their private vehicle instead, reimbursement will be based on the lesser of:

- the distance allowance for the private vehicle (including any toll charges), or

- the designated commercial carrier(s) cost for the trip.

No meal, accommodation, travel time or any other expenses will be reimbursed beyond the transportation costs.

C.1.4 Account Verification Process

- Core Policy 10.3.2(2)

- The account verification process can be tailored to reflect the risk level of the travel reimbursement claims under review. All high-risk transactions must be subjected to a review of all relevant aspects of the transaction, including a review of the supporting receipts.

- For low-risk travel reimbursement claims, the expense authority officer can conduct a "reasonableness check" to review only the most relevant aspects of each selected transaction (i.e., the payee is entitled to or eligible for the payment, the amount being reimbursed is reasonable in relation to the travel itinerary, the transaction is accurate and completed correctly, and complies with travel policies and procedures).

- High-Risk - transactions with the following criteria would be considered high-risk: highly sensitive transactions, for example travel claims that are likely to be the subject of Freedom of Information (FOI) or Public Accounts Committee requests (Groups III and IV), out-of-province travel, non-employee/contractor travel expenses, etc. This category could also include travel reimbursements of large dollar amounts or travel claims that are considered highly error prone (i.e., ministries are familiar with the current error rate from particular branches/offices).

- Low-Risk - transactions with the following characteristics would be considered low-risk: transactions that are not sensitive in nature, or have a low error rate with a low dollar value impact of error (typically low to medium dollar value, i.e., routine travel reimbursement claims).

- The expense authority officer will determine the level of assurance review they will perform on each electronic travel voucher form received. Additionally, the expense authority officer can determine, by inspection, whether the travel claim appears out-of-line and warrants a more thorough review.

- Where necessary and appropriate, the expense authority officer will retrieve the corresponding travel envelope, or electronic documentation of same, containing the supporting receipts for review purposes (the travel envelope/electronic documentation and the electronic transmission are identified by the Control Number).

- Errors, omissions or questions can be documented in a comment section on the e-form, and routed back to the employee for clarification, correction and resubmission. As the e-form information is locked, only the employee can make any changes to the information online (i.e., the signing authority officers cannot alter the document in any way).

- Once expense authority has formally certified correct the electronic travel voucher, the e-form is routed electronically for payment.

- Core Policy 10.3.16

- To claim travel expenses, employees must use iExpenses. In the rare case that employees do not have access to a computer, such as field or seasonal staff, it is acceptable to use a travel voucher . See C.14.6 for officials.

- For post audit purposes, expense authority officers should indicate on the electronic form that they are aware of or have approved any special arrangements.

- Reason for travel or justification must be completed on the iExpenses form to indicate to an expense authority where the traveller went and/or the purpose of the trip.

- For expense report preparation, delegates for iExpenses entry must not have an alternative delegate substituting for their leave or vacation period. Deputy minister expense reports are to be routed to the Executive Financial Officer or Chief Financial Officer who will act as expense authority for approving these reports.

- Relocation expenses are to be processed using the Travel Voucher form (FIN 10) (PDF) (government access only).

- The expense type 'Foreign Travel' must be used for all out-of-country travel expenses (except U.S. airfare) to ensure that no GST is calculated by the iExpenses module.

Foreign Exchange on Travel Expenses

- Core Policy 10.3.4

- Each receipt and/or allowance is to be converted to Canadian funds. Actual exchange rates charged on supporting documentation (e.g. travel credit card statements, currency exchange slips) should be used, if available. Use of the travel credit card exchange rate is the preferred option. Several rates in one currency should be averaged.

- When the travel credit card exchange rate is not available, the currency converter should be used to obtain average historical exchange rates for currency pairs for the range of dates travelled. Key in the dates travelled, select the foreign currency to convert and Canadian dollars, and then select the “Typical credit card rate plus 2%” from the “Interbank rate” drop down box. Generate the conversion table, and then use the “Average rate” for the trip to convert the foreign currency to Canadian funds.

- Refer to C.11 , Miscellaneous Foreign Travel Expenses, for additional reimbursement items.

Completion of iExpenses Claims for Foreign Travel

Claims for Expenses in US Funds

- Obtain the US exchange rate (using the travel credit card exchange rate where available, or the “Average rate” determined from the currency converter, above 2.) for US receipts, and any BC meal or per diem claim in US dollars while travelling in the U.S.A. Convert to the Canadian dollar equivalents, claim the amounts in iExpenses and specify the US exchange rate used. (e.g.: converting US$ to CDN$ when the US$ is at say, a 1.20 average rate, and a US expense was $500 would mean a converted amount of $600 CDN expenses (500 x 1.20)).

Claims for Expenses in Other Foreign Funds

- Obtain the foreign exchange rate (using the travel credit card exchange rate where available, or the “Average rate” determined from the currency converter, above 2.) for all foreign receipts and meal or per diem claims for each foreign country. Convert to the Canadian dollar equivalents, claim the amounts in iExpenses, and specify the foreign currencies (e.g.: European Euros, Japanese Yen, Chinese Yuan) and the exchange rates used.

Foreign Travel Guide (PDF) (government access only)

Refer to the CAS iExpenses User Guide (government access only) for complete information on processing expense reports.

Every employee requesting approval for out-of-province/country travel will complete the Travel Authorization form (FIN 99) (PDF) (government access only) in full. For staff (and contractor) out-of-province/country travel approval requirements, refer to CPPM 10.3.4(1) . Individual ministries may require higher approval in addition to director approval for their staff. Employees need to ensure they obtain the appropriate level of ministry approval prior to out-of-province or out-of-Canada travel.

The employee requesting reimbursement for out-of-province or out-of-Canada travel will attach copies 1 and 2 of the approved TB/FIN 99 to their travel claim.

A Travel Voucher form (FIN 10) (PDF) (government access only) is used to reimburse employees who do not have access to a computer (such as field or seasonal staff) for travel related expenses incurred while travelling on government business; otherwise use Oracle iExpenses (refer to C.1.6 ).

The travel voucher form can also be used as an invoice to reimburse employees for other related expenses (e.g., relocation allowances, etc.). Different STOBs may be used for allocating costs as applicable.

Where travel expenses are incurred in Canada, GST is calculated on the full amount of the claim. On entry, Accounts Payable staff need to select the "GST TRAVEL" tax code. Where travel expenses are incurred outside of Canada (except U.S. airfare), no GST is paid. To ensure that no GST is calculated on a foreign travel claim (e.g., STOB 5706), Accounts Payable staff do not enter a tax code.

The expenses and allowances claimed on a travel voucher are used to pay back an accountable advance where an advance has been approved and issued; a cheque is generated only for the balance due to the employee.

Attach all out-of-province travel approval forms (FIN 99) (PDF) (government access only), relocation forms and any other required documentation.

- Travel Vouchers must be legible;

- If handwritten use black or blue ink;

- To make corrections, strike a line through the incorrect information and write/type the correct information above. Do not obliterate the incorrect information or use correction tape or fluid;

- Initial changes where changes are made to Box X, Y, Z or Field 54; and

- Attach receipts in the same order that the travel is listed on the travel voucher form.

Supplementary Claims

- Claims for expenses under-claimed or overlooked are to be supported by a photocopy of the original travel voucher.

- Document numbers of all original travel vouchers for which a retroactive claim is being made;

- Number of breakfasts, lunches and/or dinners X the meal differential amount; distances previously claimed X change in distance allowance rate; and/or number of other travel allowances X rate change; and

- Total supplementary claim.

- Actual exchange rates charged on supporting documentation (e.g. travel credit card statements, currency exchange slips) should be used, if available. Use of the travel credit card exchange rate is the preferred option. Several rates in one currency should be averaged.

- When the travel credit card exchange rate is not available, the currency converter should be used to obtain average historical exchange rates for currency pairs for the range of dates travelled. Key in the dates travelled, select the foreign currency to convert and Canadian dollars, and then select the “Typical credit card rate plus 3%” from the “Interbank rate” drop down box. Generate the conversion table, and then use the “Average rate” for the trip to convert the foreign currency to Canadian funds.

Completion of Travel Voucher Claims for Foreign Travel

- Enter the actual US dollar cost and "US" in the appropriate block for each expense incurred in US funds. Also enter "US" after any BC meal or per diem claim in US dollars while travelling in the USA.

- Make one claim for US exchange (using the travel credit card exchange rate where available, or the “Average rate” determined from the currency converter, above 2.) and enter the difference as a claim in the Miscellaneous Cost column on the last day claimed on the voucher. Show the average exchange rate used and the total US amount in the miscellaneous description column. (e.g.: converting US$ to CDN$ when the US$ is at say, a 1.20 average rate for the trip, and total US expenses were $2,000 would mean a foreign exchange claim of $400 CDN in miscellaneous expenses (2,000 x 1.20 -2000)).

- Each receipt and/or allowance is to be converted to Canadian funds. Obtain the exchange rate (using the travel credit card exchange rate where available, or the “Average rate” determined from the currency converter, above 2.) for each foreign currency.

- Show each expense incurred in a foreign currency in the appropriate block of the Travel Voucher (e.g.: European Euros, Japanese Yen, Chinese Yuan), along with its Canadian dollar equivalent (using the travel credit card exchange rate where available, or the “Average rate” ). More than one line may be used for each day's expenses. Mark the Canadian dollar equivalent CDN.

- Show the average exchange rate used for each foreign currency in the miscellaneous description column, and include only amounts marked CDN when totalling daily claims.

Part Day Travel Status - Group I and Group II

Travel status begins and ends at the designated departure and return locations; these may be the employee's headquarters, personal residence, or other points of assembly as designated by an expense authority.

- On the day of departure, unless a line authority (with authority or approval for such expense) has scheduled travel status to commence before the meal period ends, employees are on personal time during their meal period and are not entitled to the allowance for that meal.

- On the day of return, unless travel status ends after the meal period begins, employees are on personal time during their meal period and are not entitled to the allowance for that meal.

Claiming Higher Per Diems (Group I and II Employees)

Where Group I and II employees/appointees are required to attend a government function with the minister, parliamentary secretary, deputy minister or associate deputy minister, a higher per diem or meal rate (Group II or III) may be authorized for the duration of the function. The executive financial officer must approve the higher limits.

Meals Inside Headquarters

- Group I - as per the applicable collective agreement or terms and conditions of employment (if a travel meal allowance is claimed, an overtime meal allowance may not be claimed for the same meal period);

- Group II - meal expenses incurred within headquarters or geographic location due to job responsibilities are reimbursed in accordance with BCPSA Policy Statement 17. Travel, Appendix 1, sec. 1 (6) (PDF) ;

- Group III - for the actual meal expenses incurred; and

- Group IV - judges or officials are not designated a headquarters. No additional claims above their daily meal allowance can be made.

- Claims must be submitted on a memorandum justifying the expenditure and processed by cheque requisition form.

- It is not the intention to provide meal expenses where employees can be reasonably expected to provide their own meals or where they are not entitled by a collective agreement. Meals considered as a business expense are an exception to the above and should be claimed on a Business Expense Approval (BEA) form.

- C.5.1 Private Vehicle Damage Reimbursement

C.5.2 Rental/Government Vehicles

C.5.3 bus and taxi charges, c.5.1 private vehicle damage reimbursement.

- Core Policy 11.3.2

Note : This section will not apply where a court holds that the employee/driver of the vehicle is guilty of wilful, wanton or gross negligence.

Claims Procedures

- a covering letter outlining the circumstances of the damage, signed by the employee and by the employee's supervisor to verify the use of the vehicle on government business;

- a copy of the police report, if applicable;

- copy of the employee's insurance documents (Owner's Certificate(s) of Insurance; a copy of ICBC repair estimate, or if ICBC coverage did not apply, copies of estimates from two (2) repair shops;

- a copy of the receipt for repair, if not repaired through ICBC; and

- a copy of the receipt for payment of the deductible portion of the loss.

- Claims are sent to the Manager, Claims Administration, Risk Management Branch, Provincial Treasury for review.

- Risk Management Branch (RMB) adjudicates the claim on behalf of ministries. It will not pay the claim.

- After reviewing the claim, RMB sends a letter to the supervisor of the employee making the claim informing the ministry of its decision and authorizing the payment amount.

Ministries will inform RMB, in writing, of the final disposition of the claim (the amount and date of the payment to the employee).

- RMB provides each ministry with an annual summary of the number and type of claims filed and the amount requested; and the number of such claims accepted/rejected and the final amount paid for each claim.

Payment Procedures

- Claims for vehicle loss(es) are processed by cheque requisition with a copy of the adjudication letter from Risk Management Branch and applicable receipts as supporting documentation. The claim will be authorized by the employee's supervisor (with expense authority).

- The expense is charged to STOB 7055, using supplier code 025726. This expense is not a taxable benefit.

- Core Policy 11.3.5

- Cargo Insurance or Personal Effect Insurance will not be purchased and will not be reimbursed. Employees are expected to follow prudent measures to protect government property while in their possession.

- Where air travel to a US destination is not a viable option, it may be appropriate to rent a vehicle under the terms of a standing agreement as the risk exposure is higher in using a government, rather than a rental vehicle to travel to the US. The rental agency must be advised that the vehicle will be taken out of the province.

- Core Policy 10.3.16(2)

- Claims for taxi costs while travelling on government business will be reimbursed when other more economical means of transportation are either unavailable or unsuitable (e.g., public transit).

- Employees can direct bill taxi costs while travelling on government business, if authorized to do so; however, they must not claim these costs for reimbursement.

- frequency of travel on short notice;

- availability of alternative methods of financing short-term travel (i.e., government approved travel card, etc.); and

- the cost of introducing additional administrative controls to ensure that duplication of charges do not occur.

- a listing of those positions authorized to charge for taxi transportation while travelling on government business; and

- a description of the methods and procedures implemented to ensure that duplicate payments are prevented and that direct billings from taxi companies include only authorized taxi expenses.

- Tips identified separately on taxi receipts (including direct billings) cannot be reimbursed as they are considered a personal expense at the discretion of employees and officials and not an expense of government (see also C.9 on gratuities).

- Core Policy 10.3.11

- Claims for the full cost of ferry travel will be reimbursed and receipts for vehicles are required. The cost of a ferry stateroom must be reimbursed only if it is used for overnight travel. Reimbursement for daytime use must have written approval from the expense authority. If used for overnight accommodation, enter the cost in the "Accommodation Costs" column of the travel voucher.

- Receipts state the type of ferry travel used such as ALT (assured loading), COMM (commuter loading) and SCRIP (pre-paid tickets for commercial vehicles). Where these types of pre-paid tickets are used, enter the appropriate abbreviation in the "Bus/Taxi/Air/Ferry Costs" column of the travel voucher form (receipts are required as supporting documentation).

Assured Loading Tickets

ALTs should only be used if necessary, as they cost more than regular fares. They must not be used where paying the regular fare will maintain your business schedule. See the BC Ferries website for ALT information.

BC Ferries Reserved Boarding

Information on reservations may be located on BC Ferries' website.

Employees are responsible for the costs associated with cancellations, except in exceptional circumstances (i.e., they are involved in a traffic accident en-route). In such an exceptional circumstance, expense authority approval is required.

Please note that as the reservation service costs more than a regular fare, a reservation is only to be made during peak travel periods. Employees must have a valid business reason for requiring a reservation.

- Core Policy 10.3.5

- Ministry expense authority officers may require the passenger copy of the air ticket to be attached to the travel claim. Indicate on the travel voucher form if QuickTickets or government air is used.

- Employees/officials/appointees are not authorized to fly private or personally rented aircraft on the employer's business (travel expenses, air travel insurance, Workers' Compensation Board coverage, etc. would not apply during this or any unauthorized travel).

- Air travel must be billed directly by vendors to ministries or paid using a Business Transaction Account (BTA) or the Purchasing Card (see the Purchasing Card Manual on airfare purchases).

- Fees assessed by a travel agency will depend on the volume, type of travel and payment method used.

To minimize travel agency fees, it is recommended that ministries/offices book directly with the air carrier for common short haul flights (i.e., harbour to harbour, Victoria airport/Vancouver airport, etc.), if the trip is not part of a larger trip itinerary.

- Core Policy 10.3.10

- Supporting hotel/motel receipts must be attached to the travel voucher. An employee must declare that "SINGLE RATE ONLY IS CLAIMED," in cases where the hotel/motel receipt shows that more than one person occupied the room.

- copy of credit card flimsy along with hotel folio;

- charge card impression on hotel folio;

- zero balance on hotel folio;

- "PAID" entered on hotel folio by hotel staff;

- a receipt stating "received from (name), in the amount of $(amount), room rental from (date) to (date)," or

- the name of the traveller and their credit card reference on the hotel folio when express check-out is claimed.

- Additional costs for the use of a kitchen unit in a hotel/motel cannot be claimed.

- Travelling employees are responsible for cancelling hotel reservations in time to avoid "no show" charges; government pays these charges where the employee has no control over the circumstance and is not at fault. The expense authority officer must decide if an employee should be held personally responsible for the charges.

Laundry and Dry Cleaning

Groups I and IV are eligible to claim laundry and dry cleaning expenses. They should be claimed in the "Miscellaneous" column of the travel voucher. All laundry expense claims must have receipts detailing items cleaned and costs. Laundry and dry cleaning expenses for Groups II and III are included in items covered by the incidental expense portion of their per diem. See BCPSA Policy Statement 17. Travel, Appendix 1, sec. 7 (PDF) .

Note: Where private lodging is used in lieu of commercial accommodation, the private lodging allowance (See BCPSA Policy Statement 17. Travel, Appendix 1, sec. 7 (PDF) ) is to help defray the added costs, including laundry, to the householder when accommodating a guest. No additional laundry claims will be accepted unless the amount was paid to a company normally in the business of supplying laundry or dry cleaning services.

Business Expenses

Business meeting expenses (to any value provided that the appropriate coding and expense authority are affixed) may be claimed on a travel voucher if incurred while an employee is on travel status. See C.14.5 for information for officials.

If business meeting expenses are claimed by Groups I, II, or III by cheque requisition (STOB 6531) while on travel status, then the cheque requisition must be cross referenced to a travel voucher. If travelling out of province, the travel voucher must be cross referenced to the cheque requisition.

Tips and gratuities are at the discretion of employees and officials and are a personal expense (i.e., not an expense of government).

For a guideline on gratuities with regard to business meeting expenses, refer to C.17.4 under General Procedures.

Business Travel Medical Insurance

Employees covered under the employer’s extended health plan are also covered under a group business travel insurance plan for travel out-of-province or out-of-country on business for the BC Public Service. Under this plan, employees are covered for medical emergencies, including those resulting from pre-existing conditions, to a lifetime maximum of $3 million. This insurance does not apply to dependents or personal travel days. When combining business and personal travel, or if family members will be accompanying business travel, employees should purchase an individual travel insurance plan covering family members and their own personal travel days.

Those employees without extended health coverage through their employment with BC Public Service are not covered under the group business travel insurance plan. There are limited exceptions. Employees without extended health coverage should confirm their travel medical insurance status prior to making travel arrangements

If out-of-province or out-of-country business travel is required, employees without coverage under the corporate travel medical policy should purchase an individual travel insurance plan and claim the expense through their travel claim. When purchasing travel insurance, make sure to read and understand the fine print. Most individual travel insurance plans exclude coverage for pre-existing conditions. Employees should carefully consider their personal health circumstances before agreeing to travel for work. For further information visit the BCPSA Travel Insurance page .

- Core Policy 10.3.15

Contractors will only be entitled to travel expenses as specified by contract. Proof that the expenses have been incurred must be attached to the travel claim.

Contractors registered with the Canada Revenue Agency (CRA) for GST purposes are entitled to claim input tax credits for the GST paid on their travel expenses and need to deduct this before they invoice ministries.

Contractors that are Small Suppliers for CRA purposes (with total annual revenues from taxable supplies not exceeding $30,000) are not required to, but can voluntarily register with the CRA for GST purposes to claim input tax credits.

Foreign Locations

- Core Policy 10.3.4(3)

For travel in the U.S. meal or per diem allowances are amounts for BC in U.S. currency, which are then converted to Canadian dollars for claim purposes (as required by BCPSA Policy Statement 17. Travel, Appendix 1, sec. 8 (1) (PDF) ).

- Core Policy 10.3.4(4)

For other foreign locations meal or per diem claims are determined in accordance with BCPSA Policy Statement 17. Travel, Appendix 1, sec. 9 (PDF) based on rates published by the federal Foreign Affairs Department.

Miscellaneous Foreign Travel Expenses

Reimbursement may be claimed for foreign currency exchange costs and reasonable expenses incurred that relate directly to foreign travel as follows (receipts must be provided):

- car rental insurance (Collision Damage Waiver (CDW) is automatically provided when an employee uses their travel card to pay for the rental vehicle)

- visa(s) and passport(s)

- inoculation(s)

- traveller's cheques

- bottled water

- preventive medication i.e., malaria tablets etc.

- premiums for additional medical insurance to provide coverage equivalent to that available under the Provincial Medical Plan in BC (Note: Premium reimbursement is only provided if the employee is not covered under the employer’s extended health plan which includes Group Business Travel Medical Insurance (see C.9 or the Foreign Travel Guide (PDF) (government access only) for more information)

- additional dry cleaning/laundry costs that are incurred as a result of exceptional foreign conditions (not claims for normal dry cleaning/laundry costs included in per diem allowances for travel in foreign locations or under C.9 )

- additional baggage insurance

- similar directly-related travel costs

Local Travel Expenses at Foreign Locations

Employees posted to or hired locally in foreign locations who are on travel status on government business will be reimbursed travelling expenses in accordance with BCPSA Policy Statement 17. Travel, Appendix 1, sec.10 (PDF) .

In accordance with BCPSA policy, job interview and post interview expenses may be provided.

In-Service Government Employees

The ministry for whom an in-service government employee incurred job interview travel expenses shall assume the payment of expenses (the ministry where the vacancy exists). This ministry should establish conditions for travel (mode of travel, number of travel days allowed, etc.), prior to the expense being incurred. Reimbursement rates will be in accordance with the employee's current group status.

Eligible travel expenses will be in accordance with current Treasury Board Directives on Travel Expenses (Treasury Board Order 88, as amended).

In-service government employees will complete a Travel Voucher form (FIN 10) (PDF) (government access only) and submit it to the Panel Chairperson.

STOB 5710 is to be used for job interview and post interview travel expenses for in-service government employee.

Out-of-Service Applicants

The ministry in which a vacancy exists may reimburse travel expenses for out-of- service applicants competing for that position at the discretion of the appropriate expense authority. Before authorizing the expense, the ministry should establish a clear understanding with the job candidate of the rates of reimbursement, mode of travel, length of travel status, and any other conditions and limitations. Normally, out-of-service applicants will be subject to Group I rates. The GST component of such costs will be reimbursed, but is not eligible for the province's rebate.

All expenses associated with travel except for airline tickets should be paid to the supplier by the person travelling. Request for reimbursement of costs shall be submitted on a travel voucher or an OCG approved ministry-specific form. Only in exceptional circumstances should an out-of-service applicant be given a travel advance. The panel chairperson or ministry personnel should arrange the air travel to ensure the most economical airfare is obtained.

Charge STOB 6503 - Job Interview Expenses for Out-of-Service Applicants and use block supplier number 135400 - Interview Expenses for Out-of-Service Applicants (includes post interview expenses for out-of-service applicants).

Ministries are to complete a cheque requisition form (FIN 188) (PDF) (government access only) with a copy of the Travel Voucher form (FIN 10) attached.

Board and lodging allowances are identified in collective agreements for bargaining unit employees and in Part 6, section 29 of the terms and conditions of employment for excluded employees/appointees .

- Core Policy 10.4.4

C.14.1 Different Types of Travel for Officials

C.14.2 party business (political), c.14.3 personal attendants for officials with physical disabilities, c.14.4 ministers' staff, c.14.5 business expenses approvals, c.14.6 reimbursement claims and payment requisitions, c.14.7 officials' office travel financial reports, c.14.8 travel charge direct billings, travel as an official (government business).

Ministry/Cabinet business includes travel related to the specific business of the ministry as well as travel related to the general responsibilities of Cabinet (e.g., a Cabinet retreat or meeting). This can include expenses in the officials' constituency (except accommodation and laundry expenses when the official is at home) if the trip is for government business.

Travel as a MLA (Legislative Business)

Caucus business is related to legislative duties, and the Legislative Accounting Office pays these expenses.

Travel expenses for party conventions, fundraising events or political functions are the personal responsibility of the official.

If an official with a physical disability requires a personal attendant in order for them to travel to discharge official duties, the personal attendant may claim at Group IV rates, for expenses incurred and allowances permitted for the period that the personal attendant aided the official in the discharge of official duties. The application of Group IV rates to a personal attendant is limited to transportation, meals, accommodation and out of pocket expenses necessarily incurred for the purpose of this travel. A personal attendant may also be a spouse.

For ministers' staff, it is not necessary to differentiate between constituency and government business. Ministers' staff are governed by the same policies and procedures that affect public servants and travel expenses are paid by the Ministry of Finance.

Business meeting expenses are to be approved in advance in accordance with ministry established approval limits.

All business expense estimates per event or function, prior to being incurred, should be reported for budgetary control purposes to the ministry's chief financial officer (who is responsible to account for the ministry's expenditure commitments-to-date, STOB 6531).