AXA Contact US

Still have a question.

Be sure to get in touch with our expert travel team. Remember to have your policy number available when contacting us.

Emergency Assistance

24 hours / 7 days a week 855-327-1442

Questions about your policy

Monday-Saturday from 8am-7pm CST 855-327-1441 Option 1

Claims status

Monday-Friday from 7:30am-4pm CST 888-957-5015

Monday-Saturday from 8am-7pm CST 855-327-1441 Option 2

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

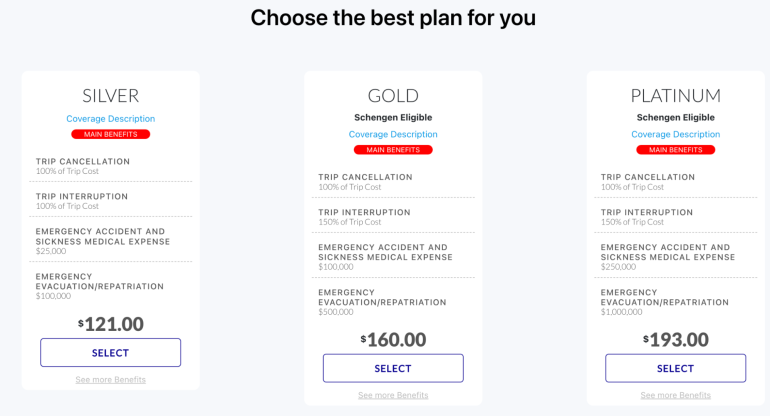

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

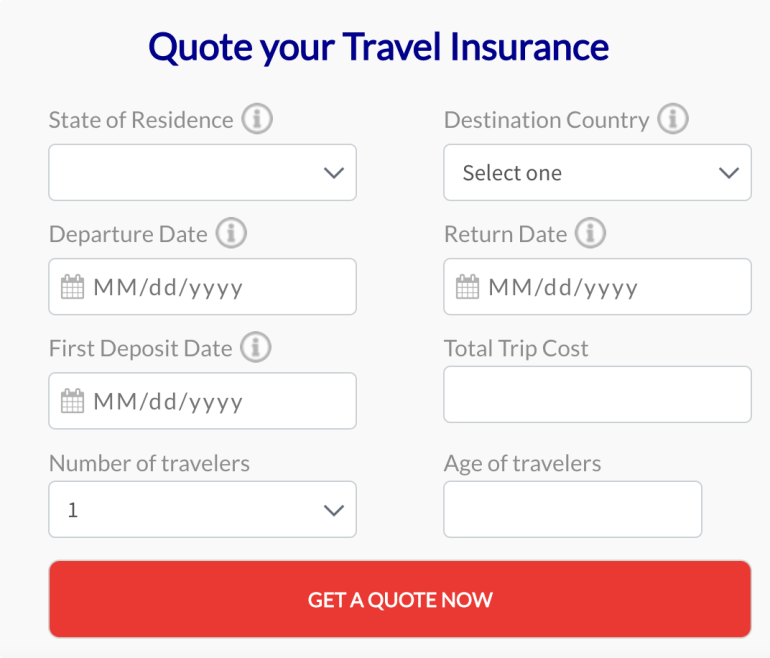

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Problems with your travel insurance claim

This advice applies to England. See advice for See advice for Northern Ireland , See advice for Scotland , See advice for Wales

Travel insurance can give you extra protection if your holiday doesn't go as planned. This is very important if you are travelling independently because you may find yourself stranded with no way to get home and no rep to rely on to help sort out your holiday problem.

Read this page to find out what you need to do if you have problems making a claim on your travel insurance policy.

before complaining to your insurer, check your policy to make sure you have a right to complain

you must first complain to your insurer using their internal complaints process

keep copies of all correspondence in case you need to take your complaint further

keep all receipts and send copies unless you're asked to provide the originals.

Can you make a claim?

If you have a problem with your travel insurance claim, it's important to check the small print in your policy to make sure that you are covered. An insurer may refuse to pay out some or all of your claim because:

you have an excess on your policy. The excess is the amount of the claim that the insurer won't pay at all. It is typically between £50 and £100

you have an exclusion on your policy. Exclusions are things for which you're not covered and usually found in the small print

you've been overcharged for what you're claiming for. An insurer will only refund reasonable costs. If these are too high, you may have to pay for part of them yourself

you didn't take reasonable care. For example, if you left bags unattended or gave them to someone you didn't know and they go missing, the insurer may refuse to pay out

your cover does not replace new for old. Insurers may pay out less than you're claiming for, to allow for wear and tear of your belongings

you left valuables in checked-in luggage

you didn't tell the insurers about a pre-existing medical condition when you bought the insurance.

How to complain about your travel insurer

If you think that you're covered and your insurer is simply acting unfairly, you can make a complaint.

Put your complaint in writing and tell the insurer how you want it resolved. If you're not happy with their response, you can make a formal complaint using the company's internal complaints procedure.

All insurers are covered by the rules of the Financial Conduct Authority (FCA) and have to deal with complaints in a certain way.

You should give the insurer up to 8 weeks to reply to your complaint. If they don't come back to you or you don't agree with their response, you can ask for a letter of deadlock. A letter of deadlock confirms that you and your insurer have been unable to reach an agreement. You can then take your complaint to the Financial Ombudsman Service (FOS). The service is free to use.

The Financial Ombudsman Service will look into your complaint and make a decision. The insurer will have to follow their decision, but you don't have to. If you don't agree and want to take your complaint further, you can take your insurer to court.

If you bought your travel insurance through a travel agent or tour operator

You can go to the Financial Ombudsman if your complaint is about your insurance policy. If your complaint is about the way the way you were sold the policy, this may be against the law.

You should get help from the Citizens Advice consumer service .

Help us improve our website

Take 3 minutes to tell us if you found what you needed on our website. Your feedback will help us give millions of people the information they need.

Page last reviewed on 20 February 2020

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

AXA Travel Insurance Review — Is it Worth It?

Jessica Merritt

Editor & Content Contributor

109 Published Articles 553 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

43 Published Articles 3389 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Table of Contents

Why get travel insurance, travel insurance and covid-19, why purchase travel insurance from axa, types of policies available with axa, how to get a quote, how axa compares — summary, how to file a claim with axa travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Whether you’re traveling the world or crossing state lines, travel insurance such as the policies offered by AXA Travel Insurance can offer a safety net in case you have to cancel or interrupt your trip or need support along the way for medical emergencies, lost bags, or missed connections.

For more than 60 years, AXA Travel Insurance has provided peace of mind and financial stability to travelers. With solid ratings and underwriting by Nationwide Mutual Insurance, travel insurance plans sold by AXA are backed by an A.M. Best Excellent financial strength rating. AXA offers travel insurance with trip interruption and cancellation coverage, medical emergency and evacuation benefits, lost or delayed baggage, and more.

Let’s examine AXA’s travel insurance coverage options, benefits, and service and compare it to alternatives such as credit card travel coverage and other travel insurance providers.

Travel insurance can protect what you’ve invested in an upcoming trip. When the unexpected occurs, such as a trip cancellation or medical need , travel insurance can offer the benefits you need to cover it.

You might choose travel insurance for these reasons:

- Your trip has deposits or payments that you can’t get refunded if you need to cancel your trip.

- The health insurance you use at home doesn’t work at your destination.

- You’re planning activities that aren’t covered by your health insurance.

- Medical care is subpar at your destination and you may need to be evacuated to another location with adequate medical facilities.

- You’re concerned about the possibility of lost bags, delays, or missed connections, especially if you have multiple flights or transfers.

Travel insurance isn’t necessary for every trip, such as if you’re traveling domestically where your health insurance works and you don’t have major nonrefundable expenses. But travel insurance is worth it if you’ve got a lot of nonrefundable expenses invested in your trip or you’ll need medical coverage at your destination.

COVID-19 can interrupt your travel plans, whether you get sick and have to cancel a trip, need to quarantine or get medical treatment while traveling, or plan to visit a destination with high COVID-19 numbers. While some travel insurance companies exclude COVID-19 from insurance coverage , AXA offers COVID-19 coverage as part of its travel protection plans , including trip cancellation and trip interruption and emergency medical and evacuation coverage.

Any travel insurance company you purchase a policy from should be reputable, reliable, and stable. After all, you’re relying on the company to be there for you when you need it most. It pays to verify reviews and ratings — AXA offers good reassurance in this area.

With 64 years in business, AXA has an A- Better Business Bureau rating . On the travel insurance website Squaremouth , AXA has an overall 4.22/5 rating , with 0.1% negative reviews among more than 69,000 policies sold . AXA’s travel insurance plans are backed by Nationwide Mutual Insurance, which has an A (Excellent) financial strength rating from financial rating company A.M. Best. With 6 decades in business and solid ratings , AXA is a travel insurance company you can trust.

AXA offers travel insurance with medical and emergency evacuation benefits, trip cancellation and interruption, baggage loss, and Cancel for Any Reason (CFAR) options. Let’s look at the details of AXA travel insurance policies.

AXA offers 3 levels of travel insurance : Silver, Gold, and Platinum . Each level offers different limits, but all of AXA’s policies have 100% trip cancellation coverage, emergency medical coverage and medical evacuation, baggage delay and loss, and missed connection coverage.

Let’s compare what you get with each policy:

With plans as low as $16 and minimal coverage, AXA recommends the Silver plan for domestic travel. You can cover 100% of your trip cost for trip cancellation and interruption coverage. If your travel is delayed, you can get up to $100 per day for expenses, up to $500 total, and $200 for delayed baggage.

There’s also $500 in missed connection coverage. The $25,000 in emergency medical expense coverage isn’t much, but it might be adequate for domestic travel if you’re using your primary health insurance first.

Gold plans start at $36 but add more coverage and are appropriate for cruises or Schengen travel . Like the Silver plan, the Gold plan offers up to 100% trip cancellation coverage but bumps trip interruption to 150% of your trip cost. Limits for all coverages are higher, with $200 per day and $1,000 maximum in trip delay coverage and $1,000 for missed connections. Baggage delays offer up to $300, and you can get up to $1,500 for lost baggage and personal effects.

The health coverage is also much higher at $100,000, and it adds a $50,000 non-medical emergency evacuation option on top of the $500,000 medical emergency evacuation benefit. This plan also offers an optional $35,000 collision damage waiver.

The Platinum plan , starting at $52, steps up coverage and offers additional options. You’ll get 100% trip cost coverage for trip cancellation and 150% for trip interruption. Trip delay coverage offers up to $300 per day and a $1,250 maximum, plus $600 for baggage delays and $3,000 for lost baggage and personal effects.

Emergency medical treatment is also higher at $250,000, and you’re covered for $1 million in emergency medical evacuation — $100,000 for non-medical evacuation.

The Platinum plan also offers additional coverage for sports, with $25 per day for lost skier days, $500 for lost golf rounds, and $1,000 for sports equipment rental. It also offers optional coverage for up to 75% of trip cost with Cancel for Any Reason coverage and a $50,000 collision damage waiver.

You can get a quote directly from AXA by visiting the AXA Travel Insurance website . The quote form is the first thing you’ll see on the homepage.

To start your quote, you’ll fill out the quote form, including your state of residence, destination country, travel dates, first deposit date, total trip cost, number of travelers (up to 10), and the age of travelers.

Once you fill out the form, you’ll be presented with plan options. For a 60-year-old visiting Japan and spending $2,500, we were offered a Silver ($155), Gold ($183), or Platinum ($218) plan .

If you select a Platinum plan, you will be able to add CFAR optional coverage for up to 75% of your trip cost.

With your plan and options selected, the next and final step to secure coverage is entering your traveler information including your name and contact information, then making your payment for the policy.

AXA is a good option for travel insurance, but it’s not your only option. Let’s see how AXA compares to the coverage you can get from popular travel credit cards and travel insurance competitors .

AXA vs. Credit Card Travel Insurance

Many travel credit cards offer travel insurance as a complimentary benefit, whether it’s car rental collision waivers , trip cancellation coverage , or emergency medical and evacuation benefits. This coverage can be helpful if you’re using your card to pay for your travel expenses, but it’s often not as comprehensive as the coverage you can get from a travel insurance policy like what AXA offers .

Let’s compare AXA’s best travel insurance policy against The Platinum Card ® � from American Express and the Chase Sapphire Reserve ® , which both offer some of the best travel protections available with credit card benefits.

Unless you’re taking a trip with expenses higher than $10,000, the trip cancellation coverage should be about the same whether you’re using an Amex Platinum card, Chase Sapphire Reserve card, or the AXA Platinum plan. However, the AXA Platinum plan comes out ahead with 150% of your trip cost for trip interruption.

We see a major difference in coverage for emergency medical treatment and evacuation. The Amex Platinum card doesn’t offer emergency medical coverage, but you can arrange an emergency medical evacuation using the Premium Global Assist Hotline. The Chase Sapphire Reserve card offers up to $2,500 in emergency medical coverage and $100,000 for emergency evacuation. Neither of these offerings compares to the $250,000 in emergency medical coverage and $1 million in emergency medical evacuation coverage you can get from AXA Platinum.

Credit card travel insurance coverage is complimentary if you already have the card, but it is lacking in some areas. It’s a good idea to use your card’s travel insurance as a backup for trip cancellation, interruption, travel delays, or lost baggage, but use the AXA Platinum plan for its superior emergency medical and evacuation coverage.

AXA vs. Other Travel Insurance Companies

It’s always a good idea to compare travel insurance quotes across multiple providers so you can find the best price and coverage. We used Squaremouth , a travel insurance comparison website, to see how AXA’s policies compare to those of other companies.

As with the initial price quotes we pulled from AXA’s website, our sample trip on Squaremouth had:

- Traveling to Japan a month from now

- Trip cost: $2,500

- Initial trip deposit paid within the last 24 hours

- State of residence: Texas

We limited results to policies that offer at least as much coverage as the AXA Platinum policy does on major benefits:

- COVID-19 coverage

- Minimum $250,000 emergency medical benefit

- Minimum $1 million emergency medical benefit

- 100% trip cancellation

- 150% trip interruption

Each policy offered nearly identical coverage for these major benefits, and Tin Leg ‘s Silver plan had the lowest cost at $164.35, followed closely by $165.84 from HTH Worldwide ‘s TripProtector Classic plan.

If you’re mainly concerned with full coverage for trip cancellation and interruption along with $250,000 in emergency medical and $1 million for emergency medical evacuation, you can save if you go with Tin Leg .

However, the higher-priced policies offer additional coverage and options. For example, AXA Platinum offers the option to add Cancel for Any Reason coverage and includes sports equipment rentals and missed ski days or golf rounds. Tin Leg doesn’t have missed connection coverage, but Seven Corners Trip Protection Choice and AXA Platinum offer up to $1,500 for missed connections on cruises or tours.

All of the policies we quoted except for Tin Leg Silver offer employment layoff as a covered cancellation reason, and AXA Platinum allows you to cancel your trip for work reasons, though none of the other policies do. AXA Platinum also offers $100,000 in non-medical evacuation , which Tin Leg Silver and HTH Worldwide TripProtector Classic policies do not, and is much higher than the $20,000 benefit offered by the Seven Corners Trip Protection Choice policy.

AXA Platinum has a higher cost than competitors but offers more robust coverage. If you’re mainly concerned with major coverage for trip cancellation and interruption, emergency medical, and emergency evacuation, other travel insurance companies may offer a better quote. But if you want additional coverage and options such as non-medical evacuation and expanded cancellation reasons, check out the details on what AXA Platinum offers.

You can file a claim with AXA in a few ways:

- Using the claim administrator portal

If you’d like to file your claim online, you can visit the portal for Co-Ordinated Benefit Plans and enter your policy number and last name to get started.

Alternatively, you can call AXA toll-free at 888-957-5015 or collect at 727-450-8794 .

If you’d like to submit your claim via email or mail, you can download claim forms on the AXA website.

Once you download the claim form, you’ll get a list of documents required for submitting your travel insurance claim, along with mail or email info. For example, on a trip interruption claim form, AXA requires you to send in:

- Completed claim form

- Policy verification

- Booking confirmation, such as a ticket or proof of purchase

- Your original unused, nonrefundable tickets

- Your new ticket with confirmation of early return

- A cancellation statement from travel suppliers

- A medical report or physician statement if you interrupted the trip due to medical necessity

- Death certificate, if applicable

- Documentation of circumstances that led to trip interruption

- Documentation of reimbursement request expenses, such as receipts or credit card statements

You can email the form and other required documents to [email protected] or mail to:

AXA Assistance USA On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies P.O. Box 26222 Tampa, FL 33623

AXA Travel Insurance is a reliable option with more than 6 decades of experience and solid ratings. There are 3 levels of coverage to choose from — Silver, Gold, and Platinum — that offer varying levels of coverage and options. AXA Travel Insurance isn’t the cheapest option, but it offers robust coverage options and reputable service, so it can be a good choice if you’re looking for enhanced travel protection.

For the premium global assist hotline benefit of The Platinum Card ® from American Express, you can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, we may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

For the car rental loss and damage insurance benefit of The Platinum Card ® from American Express, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the baggage insurance plan benefit of The Platinum Card ® from American Express, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the trip delay insurance benefit of The Platinum Card ® from American Express, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of The Platinum Card ® from American Express, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For rates and fees of The Platinum Card ® from American Express, click here .

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , Tin Leg , Faye , and Faye2 .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

Best Price Guarantee By Comparing Top Policies In A Single Platform

- Buy online and get instant coverage by email

- 24/7 emergency assistance worldwide

- Policies from trusted providers

- Over 100,000 verified customers with 5-star reviews and $3.5 billion in protected trip costs

- Includes coverage from theft, trip cancellations, baggage loss and delay, medical expenses for hospital treatments

- Travel Insurance

AXA Travel Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , Tin Leg , Faye , and Faye2 .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is AXA Travel Insurance rated?

Overall rating: 4.5 / 5 (excellent), axa travel insurance plans & coverage, coverage - 4.5 / 5, emergency medical coverage details, baggage coverage details, axa travel insurance financial strength, financial strength - 4.8 / 5, axa travel insurance price & reputation, price & reputation - 4.7 / 5, axa travel insurance customer assistance services, extra benefits - 4.2 / 5, travel assistance services.

- Translation Services

Emergency Medical Assistance Services

- Physician Referral

Concierge Assistance Services

- Restaurant/Event Referral and Reservation

Our Comments Policy | How to Write an Effective Comment

Customer Comments & Reviews

Related to travel insurance, top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

File a Claim

Still have a question? Be sure to get in touch with our expert travel team

You can also claim directly or check the status of an existing claim at our claims administrator’s 24/7 self-service portal at: https://cbpconnect.com

You have reached AXA USA, your Travel Protection solution for US Residents. Our team of experts are available to you for claims assistance. If you are looking for information on how to file a claim and you are not a US Resident please review your travel documents for the appropriate contact details. If you are a US Resident and purchased an AXA Silver, Gold, or Platinum plan please find the necessary claim forms and instructions below.

How can I contact someone about my claim?

Before you submit a claim.

Contact AXA USA for emergency medical and travel assistance including any prior arrangements for evacuations and medical repatriations. In the event of theft or loss of property, contact the police or transportation carrier such as the airline immediately to obtain a filed report

- ✔Check your policy documents to confirm your coverage details

- ✔Review the claim form for supporting documentation required

- ✔Contact AXA USA for any policy and claim questions

Download your claim forms below

Claim forms are for SILVER, GOLD, and PLATINUM plans only.

Trip Cancellation

Provides coverage for non-refundable payments and deposits made before your trip was cancelled due to a covered reason. This is a pre-departure benefit.

Cancel For Any Reason

Provides coverage for non-refundable payments and deposits made before your trip was cancelled. Only available on the Platinum plan as an optional benefit. This is a pre-departure benefit.

Trip Interruption

Provides coverage for non-refundable trip cost in the event you cannot continue your trip due to a covered reason. This is a post-departure benefit.

Provides coverage for the unsed portion of pre-paid expenses, accommodations, meals, and transportation expenses if you experience a delay while traveling.

Provides coverage for emergency medical expenses resulting from an accidental injury or sickness incurred while on the trip.

Accidental Death or Dismemberment

Provides coverage if you suffer an injury resulting in loss of life or limb during a covered part of your trip.

Baggage Delay

Provides coverage if your baggage is delayed 24 hours on Silver and Gold and 12 hours on Platinum.

Provides coverage if your baggage or personal effects are lost, damaged or stolen during your trip.

Collision Damage Waiver

Provides coverage if you rent a car while on your trip, and the car is damaged due to collision, theft, vandalism, windstorm, fire, hail, flood, or any cause not within your control while the car is in your possesion.

MY TRIP COMPANION

Not just a travel app but a comprehensive travel assistant that enhances your travel experience.

14-Feb-2024 • Knowledge

Information, new section, how to make a complaint about your axa car insurance policy.

We're sorry you're unhappy with your policy - let's see if we can turn this around for you.

To make a general complaint about your policy or our service

The quickest way is to fill in our contact form Alternatively, you can call us on 0330 024 1158. Our teams are available Monday to Friday between 8am to 8pm and Saturday 9am to 5pm. Bank Holiday times may vary.

To make a complaint about your claim

You can email the team here or alternatively, you can call us on 0330 024 1305. We’re available Monday to Friday between 9am and 5pm.

What can I do if I’m not happy with your response to my complaint?

If you’re not satisfied with how we’ve resolved your complaint, you may be eligible to refer your case to the Financial Ombudsman Service for independent review. You have six months from the date of our final response to refer your complaint to the Financial Ombudsman Service and this doesn’t affect your right to take legal action. If we can’t resolve your complaint in the way that you wanted, you can refer to: The Financial Ombudsman Service, Exchange Tower, London, E14 9SR. Tel: 0800 032 8000 Fax: 020 7964 1001 Email: [email protected]

How we'll deal with aggressive, threatening or abusive behaviour

We’re here to help you, but we won’t accept aggressive, threatening or abusive behaviour.

If you (or someone acting on your behalf) are abusive when speaking to or messaging us, or our trusted suppliers, we’ll take action. This might mean we end our conversation with you, limit the ways we’ll get in touch with you in future, and in extreme cases we may cancel your cover.

For more information, refer to our Terms and Conditions , or check your policy wording in your online account.

Manage your policy

Manage everything you need - in one place

With your AXA online account, you can:

- Change, update and manage policy details with no admin charges

- Print and view your documents

- Make a claim

- View your renewal

Your policies may be renewed automatically, to ensure you're always covered.

You'll receive an email (and text, if you’ve provided your mobile number) reminder, just before it's up for renewal.

Browse by Sector

- Public Services

- Restaurants

This website uses cookies to enable essential site functionality, as well as marketing, personalised ads, and analytics. You may change your settings at any time or accept the default settings. View our cookie policy here.

Personalised Ads

- Get started

AXA complaints

Contact axa customer service.

Resolver can help you send your complaints to AXA. It’s quick, easy and totally free.

How does Resolver work?

Free forever.

Resolver is free. Just raise a case and leave feedback after. Simple! We’ve helped millions of people find a resolution. Get started now and let’s get this sorted.

Know your rights

There’s no jargon in our rights guides. Instead, they’re full of the info you need to get things sorted. We’ll always be on hand with guidance and support to help you get the results you’re looking for.

Get your voice heard

You can be certain that you’re talking to the right person at the right time. We automatically connect you to contacts at thousands of household names, ombudsmen and regulators to find a resolution.

How to complain about AXA customer service

Resolver is a completely free complaint-resolution tool that puts the British consumer directly in touch with the customer service providers who can resolve their complaint.

By providing you with all the tools and contact details needed to raise and manage your complaint, we put you firmly in control of your issue.

Head Office address

Phone number: 03300241158.

Please check with your phone provider if you are unsure about how much a call will cost.

Using Resolver you can:

- Keep all your correspondence in one place

- Go straight to the correct contact point within an organisation

- Make use of a series of simple templates to help make raising your complaint as simple and quick as possible

- Receive reminders when you get a response from a company or organisation

- Get an automatic notification when it's appropriate to escalate your case to the next management level within a company

- Package up and send off the whole history of your complaint to an ombudsman or other regulatory body if necessary

Need help complaining?

Resolver is a totally free service that you can use to complain effectively. We are working with industry leaders, regulators and government to make your voice heard and improve customer service. However, if you'd rather complain directly, you can use the above address to contact AXA.

Want to start a complaint about AXA?

Tell your friends about resolver.

Want to help others get their issues sorted fast or see the latest updates about how Resolver can help you? Then like us on Facebook and follow us on Twitter .

Working with

With Resolver you can send your case to key ombudsmen and regulators including:

Travel Insurance

- Car Hire Excess

- Coronavirus

- Members Area

Frequently Asked Questions

- How do I make a complaint?

We aim to provide the highest standard of service to every customer.

If our service has not met your expectations, we want to hear about it so we can try to put things right.

All complaints we receive are taken seriously. The following will help us understand your concerns and give you a fair response.

Making your complaint

Claims and medical assistance complaints

If your complaint relates to:

- a claim you are trying to make (apart from Gadget Cover claims)

- a claim you have made and are awaiting an update for (apart from Gadget Cover claims)

- medical assistance you received while on a trip

The AXA Assistance team will need to receive and review the details of your complaint.

You can contact the AXA Assistance team by:

- Email at [email protected]

- Phone on 01737 815 227

- Post to: AXA Travel Insurance, Head of Customer Care, The Quadrangle, 106-118 Station Road, Redhill, Surrey, RH1 1PR, United Kingdom

Gadget Cover claims

If your complaint relates to the Gadget Cover section of your policy, or a claim you have made for Gadget Cover, the Davies Group complaints team will need to receive and review the details of your complaint.

You can contact the Davies Group complaints team by:

- Email at [email protected]

- Phone on 0345 074 4813

- Post to: Davies Group, Unit 8, Fulwood Business Park, Caxton Road, Fulwood, Lancashire, PR2 9NZ, United Kingdom

Policy administration and customer service complaints

- purchasing or making change to your insurance policy

- your experience using our website and online forms

- customer service you received when contacting the Coverwise call centre

Please contact our Sales and Service team by:

- Email at [email protected]

- Phone on 01903 255 650

- Post to: The Operations Manager, 4th Floor, Southfield House, 11 Liverpool Gardens, Worthing, West Sussex, BN11 1RY

Alternatively, if you would prefer to provide the details of your complaint online, please visit our Contact Us form and select the relevant option.

What to provide when making your complaint

To help the complaints teams investigate your complaint quickly and thoroughly, please be sure to provide:

- Your claim number (if applicable)

- Your Coverwise policy number (if applicable)

- Your full name, email address, phone number and postal address

- Details of your experience and the reason you would like to make a complaint

- Copies of supporting material (if applicable)

The Financial Ombudsman Service

If you remain dissatisfied following the final written response you receive, you may be eligible to refer your case to the Financial Ombudsman Service (FOS).

The FOS is an independent body that arbitrates on complaints about general insurance products. You have 6 months from the date of the final written response you receive to refer your complaint to the FOS, and doing so does not affect your right to take legal action.

You can contact the FOS by:

- Email at [email protected]

- Phone on 0800 023 4567

- Post to: The Financial Ombudsman Service, Exchange Tower, Harbour Exchange Square, London, E14 9SR

Related Questions

- Who Are Coverwise?

- Why should I buy a policy from Coverwise?

- What services do you offer?

- How do I provide feedback?

- Do you have a Privacy Policy?

FAQ Categories

- Company information (6)

- Destinations and regions (7)

- Eligibility (11)

- General cover enquiry (24)

- Health (18)

- Product Information (16)

- Policy administration (8)

- Purchase information (4)

- Sports and Other Activities (6)

- Help and Assistance (10)

- Coronavirus (COVID-19) (14)

- 24/7 Medical Consultation Service (8)

- Claims (14)

- Ski Insurance

- Business Insurance

- Annual Travel Insurance

- Single Trip Travel Insurance

Information

- News and Press

- Customer Reviews

- Pre-Existing Medical Conditions

- How to claim

- Policy Documents

- Environment

- Accessibility

- Terms and Conditions

- Privacy Policy

- Cookie Policy

IMAGES

VIDEO

COMMENTS

This summary does not replace or change any part of your plan document. If there is a conflict between this summary and your plan document, the plan document will govern. Please contact AXA for additional information regarding plan features and pricing at [email protected]. Plans contain insured benefits and non-insurance assistance ...

Questions about your policy. Call us at 855-341-9877 option 1. Our hours of operation are Monday through Saturday 8am-7pm CST. Have questions or concerns in regards to your AXA Travel insurance policy purchased in the US. Please get us a call or email us.

Please contact AXA for additional information regarding plan features and pricing at [email protected]. Plans contain insured benefits and non-insurance assistance services. The insurance benefits in the Silver, Gold and Platinum plans are underwritten by Nationwide Mutual Insurance Company, Columbus, Ohio In WA coverage is ...

Car insurance. Get AXA Car Insurance from as little as £306 (10% of AXA Comprehensive Car Insurance customers paid this or less between 1 May and 31 July 2024). We pay out 99.8% of car insurance claims (Data relates to personal car insurance claims for policies underwritten by AXA Insurance UK plc from January to December 2023). Find out more

View customer complaints of AXA Assistance USA, Inc., BBB helps resolve disputes with the services or products a business provides. ... My partner and I bough travel insurance through AXA for a ...

Benefits are administered by AXA Assistance USA, Inc. (in California, doing business as AXA Assistance Administrators, License Number 0H74893). Non-insurance assistance services are provided by AXA Assistance USA, Inc. and are not underwritten by Nationwide Mutual Insurance Company. For more information about the AM Best rating, please

Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip cost ...

Travel protection is the combination of travel insurance and travel assistance services available 24/7. Travel protection helps provide you peace of mind when away from home; whether traveling abroad or within the U.S. Plan your trip with the knowledge you will be protected - should you need it - through AXA USA.

nClaim NotificationTo make a claim please call the TUI Claims call centre. n +353 (1) 920 3988.(Opening times: Monday to. Friday: 8am - 6pm. Sa. urday: 9am - 1. aking yourself heardAny complaint you may have should in the first instance be addressed to the relevant helpline as outlined withi.

If you have a complaint about your travel insurance policy, talk to your insurer first. They need to have the chance to put things right. They have to give you their final response within eight weeks for most types of complaint. If you bought the policy online and/or without any advice, the insurer might be the right person to direct a mis-sale ...

How to complain about your travel insurer. If you think that you're covered and your insurer is simply acting unfairly, you can make a complaint. Put your complaint in writing and tell the insurer how you want it resolved. If you're not happy with their response, you can make a formal complaint using the company's internal complaints procedure.

Customer Care. If we cannot sort out your complaint, you can contact our Customer Care Department. Contact details are for Republic of Ireland customers only. Contact details for Northern Ireland customers can be found here. Send us an email: Click here. By phone: 0818 505 505. By post: AXA Insurance, Customer Care Department, Freepost, Dublin 1.

On the travel insurance website Squaremouth, AXA has an overall 4.22/5 rating, with 0.1% negative reviews among more than 69,000 policies sold. AXA's travel insurance plans are backed by Nationwide Mutual Insurance, which has an A (Excellent) financial strength rating from financial rating company A.M. Best.

Travel Insurance Claims. Continue an existing claim. My Account. navigate_next. Start a new claim. navigate_next. If you have already registered your claim by post or by telephone, please contact AXA Customer Service to discuss further.

Overall Rating: 4.5 / 5 (Excellent) AXA travel insurance covers a wide variety of travel-related losses, including luggage damage and theft, medical issues, and trip interruption. Its adventure travel policy is especially robust and not only covers traditional adventure activities but also reimburses policyholders for sports equipment rentals ...

Contact AXA USA for emergency medical and travel assistance including any prior arrangements for evacuations and medical repatriations. In the event of theft or loss of property, contact the police or transportation carrier such as the airline immediately to obtain a filed report. Check your policy documents to confirm your coverage details.

To make a general complaint about your policy or our service. The quickest way is to fill in our contact form. Alternatively, you can call us on 0330 024 1158. Our teams are available Monday to Friday between 8am to 8pm and Saturday 9am to 5pm. Bank Holiday times may vary.

AXA Assistance USA's Platinum plan (above) is its highest-rated plan according to Forbes Advisor's ratings of the best travel insurance. AXA Assistance USA's Silver plan: The Silver plan ...

Commercial - [email protected]. Personal - [email protected]. If you have authority to handle complaints on our behalf (as a delegated complaint handling authority) then remember to notify us that a complaint has been received through your normal channel (such as the COMI return).

How to make a complaint about your AXA Investment Managers account. We want you to be able to complain in any way you choose. If you are dissatisfied with our service please let us know: Call us on: 0345 777 5511 from the UK or 00 (44) 1268 448 667 from overseas. Our lines are open 9:00am-5:30pm Monday to Friday.

Insurance and pure protections. 9.45. 28,525. 30,358. 26.6%. 51.3%. 59.3%. Other General Admin / Customer Service. During the 6 month period ending 30 June 2024, AXA Insurance UK plc received 9.45 complaints for every 1,000 policies in force.

Resolver is a completely free complaint-resolution tool that puts the British consumer directly in touch with the customer service providers who can resolve their complaint. By providing you with all the tools and contact details needed to raise and manage your complaint, we put you firmly in control of your issue. Contact details.

The AXA Assistance team will need to receive and review the details of your complaint. You can contact the AXA Assistance team by: Email at [email protected]; Phone on 01737 815 227; Post to: AXA Travel Insurance, Head of Customer Care, The Quadrangle, 106-118 Station Road, Redhill, Surrey, RH1 1PR, United Kingdom